Kerala property tax payment has become seamless with the KSMART building tax online payment and Sanchaya portal, allowing property owners to pay building tax Kerala online and instantly download property tax receipts.

This guide covers all essential steps and keywords for a hassle free experience.

You can pay your property tax online in Kerala using two convenient methods as the Quick Pay option (no login required) or by logging in as a registered user.

Both methods are accessible through the official Ksmart portal (Local Self Government Department) and support multiple payment modes.

Kerala Property Tax Payment with Ksmart Quick Pay

- Visit the official Sanchaya portal at ksmart.lsgkerala.gov.in/ui/web-portal

- Go to Quick Service and Click Property Tax

- Tap on Property Tax Quick Pay option

- Select any Search mode (Smart Search or Advanced Search)

- If Selected Smart Search, then Enter Mobile Number or Building Number or Aadhaar Number

- If Selected Advanced Search, then select the required details:

- District name

- Local body type (Municipality, Corporation, or Panchayat)

- Local body name

- Ward year and ward number

- Door or sub number

- Select Search Type (Door Number / Sub No / Owner Name / Institution Name)

- Enter Door No / Sub No

- Click the Search button to view property details and pending tax.

- Select the payment period and enter your email ID and mobile number.

- Click Pay Now.

- Choose your preferred payment method (credit/debit card, net banking, UPI, RTGS, NEFT, or mobile wallet) and complete the payment.

- Download the payment receipt for your records.

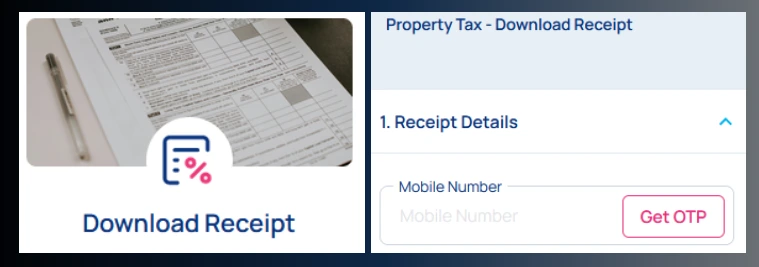

How to Get Kerala Property Tax Receipt after Payment

- Proceed with first 2 steps in payment as above.

- Click Download Receipt.

- Enter Mobile number provided at the time of payment.

- Tap on Get OTP.

- Enter OTP and validate.

- Verify the list of transactions and click on respective payment.

- Download your Kerala property tax receipt through Ksmart application portal.

Ksmart Building Tax Online Payment with Login

The portal supports Kerala property tax payment for previous years and offers real-time payment status checks.

- Go to the Sanchaya portal at https://ksmart.lsgkerala.gov.in/ui/home/citizen/login.

- Enter your username and password to log in, or register as a new user if you don’t have an account.

- After logging in, select your local body (Municipality, Corporation, or Panchayat) and district.

- Click the ‘Search’ button to display your property details.

- Choose the ‘Property Tax’ option.

- Enter the ward year, ward, and door/sub number, then click Search.

- Review your property and tax details.

- Enter your registered email, mobile number, and captcha code, then click ‘Pay Now’.

- Complete the payment using your preferred online payment method.

- Download the payment receipt after successful payment.

Additional Features:

- Plinth Area Search: You can also search and pay your property tax using the plinth area by selecting the relevant option and entering your ward number, ward year, and door number.

- Receipts & Certificates: After payment, you can download your payment receipt and apply for ownership certificates or other property related documents via the portal.

Kerala property tax payment is now efficient and user-friendly, leveraging KSMART building tax online payment and Sanchaya portal services accessible for both residents and NRI properties, ensuring your property tax Kerala obligations are met securely and receipts are always accessible.