Understanding the Haryana Property Tax Calculator is essential for property owners to calculate and pay their taxes accurately.

When using the Haryana property tax calculator, it is essential to understand the broader framework of property tax management in the state. Platforms like the ULB Haryana property tax portal not only simplify tax calculations but also provide streamlined services for registration, login, and payment.

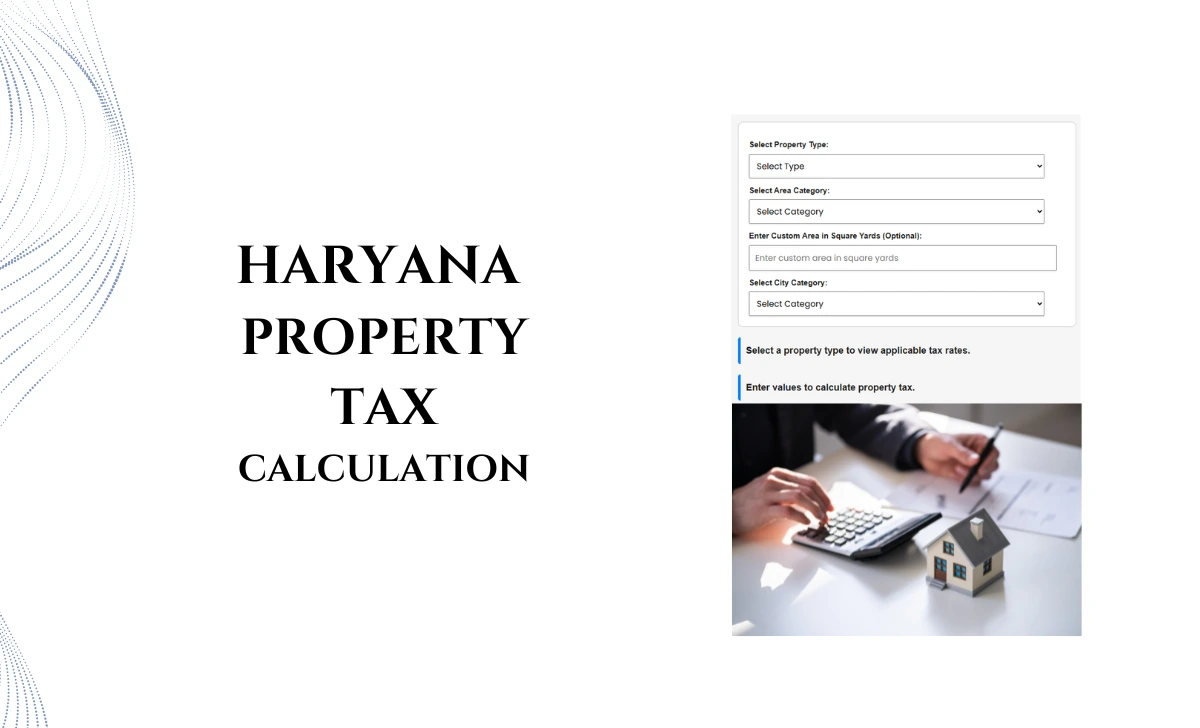

Haryana Property Tax Calculator

This tool provides by taxlekka simplifies the tax computation process by considering factors such as property type, size, location, and applicable rates. This ensures that property owners, including NRIs, can efficiently manage their dues while complying with local regulations.

How to Use Haryana Property Tax Calculator

By using this calculator, individuals can avoid penalties and contribute to civic development through the below steps to use the calculator effectively.

- Select Property Type

- Select Area Category

- Enter Custom Area (Optional)

- Select City Category

- The third dropdown allows you to select the city category where your property is located:

- A1 Cities: Gurgaon and Faridabad

- A2 Cities: Ambala, Panchkula, Karnal, Panipat, Rohtak, Hisar, Yamunanagar

- View Applicable Tax Rates

- Automatic Calculation

- Once all required fields are selected or entered, the calculator will automatically compute the total property tax based on:

- The applicable tax rate for your property type and area.

- The city category.

- If a custom area is entered, it will be used for calculations instead of the predefined area categories.

- View Results under the Property Tax to be paid section.