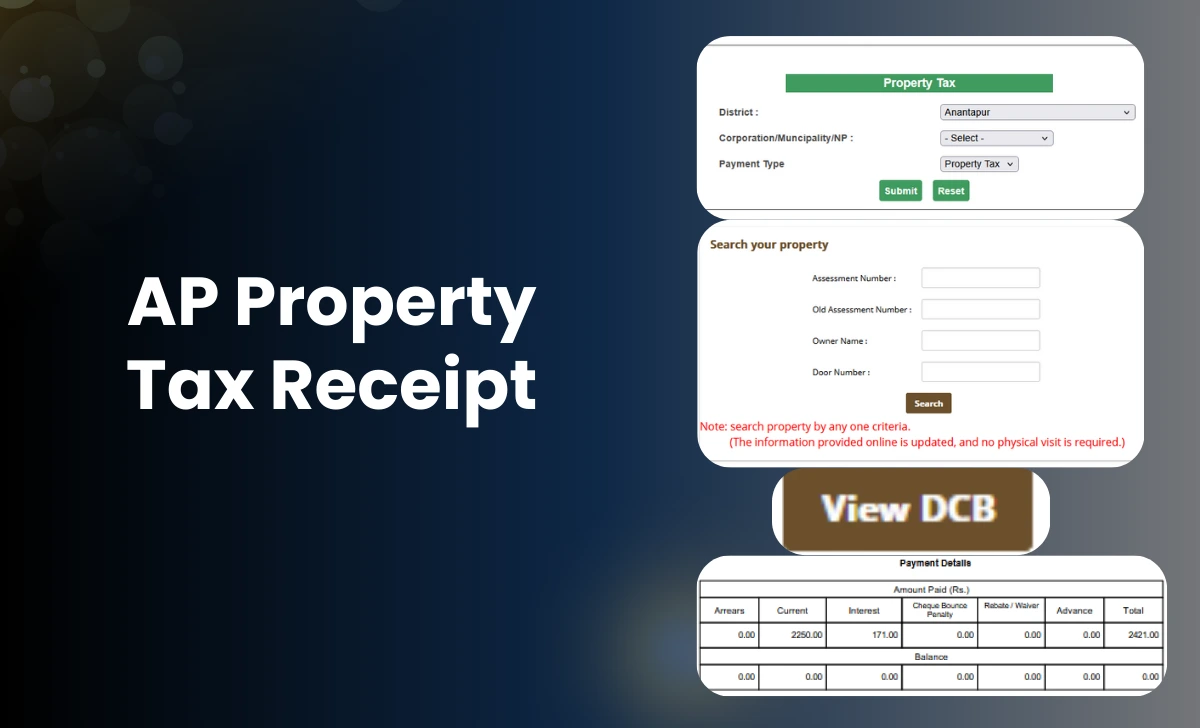

AP Property Tax Receipt Download in 7 Steps for 2025

Downloading your AP property tax receipt is an essential step after making your municipal property tax payment in Andhra Pradesh, providing you with official proof of payment for legal, financial, and record-keeping purposes. This house tax payment receipt process streamlined and may completed entirely in online through the official CDMA portal. To download your AP Property Tax Receipt, follow this precise, step by step process ...