Keeping your contact information updated with the Greater Chennai Corporation (GCC) ensures you receive timely notifications and important updates regarding your property tax.

Here’s a step-by-step guide on how to register or update your mobile number and email ID for your Chennai property tax bill.

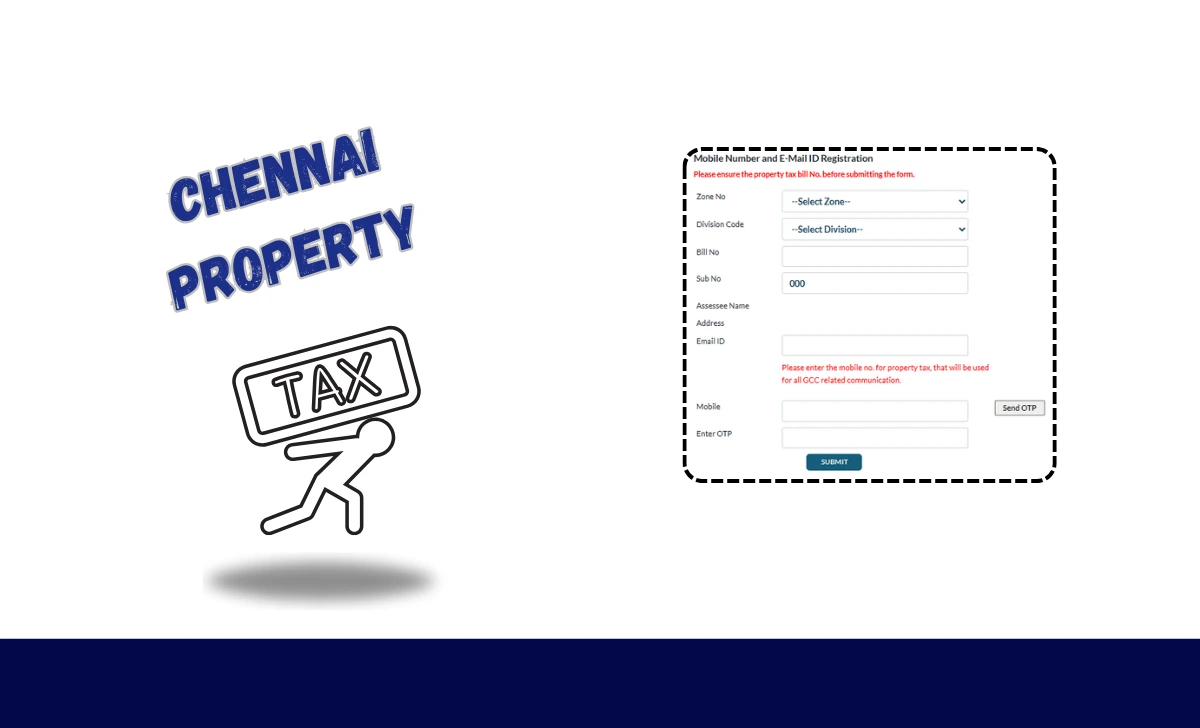

Steps for Registering / Updating Mobile Number and Email for Chennai Property Tax Bill

- Open the official Registration Page at chennaicorporation.gov.in/gcc/

- Select the appropriate zone number for your property.

- Choose your division from the dropdown list.

- Enter your Property Tax Bill Number (this is a unique identifier for your property, usually found on your Chennai property tax receipt).

- Provide Sub Number

- The system will fetch your property details (such as Assessee (owner) name and address) and display them on the page.

- Check the displayed property details to ensure they match your property.

- Enter your email ID in the field.

- Enter your mobile number in the provided field.

- Click Send OTP

- Enter OTP received on your mobile.

- Click the Submit button.

If the submission is successful, a confirmation message will appear on the screen, and Your mobile number / email are now registered or updated for Greater Chennai property tax communication

Notes:

- Make sure you enter the correct Bill Number, Zone, and Division to avoid errors.

- Use an active mobile number and email ID for timely notifications.

- If you face issues, contact the GCC helpdesk or visit your local zonal office.

Why to Register Your Mobile Number and Email for GCC Property Tax Bill?

- Receive reminders about Chennai property tax payment due dates.

- Get payment receipts and official communications directly.

- Stay informed about any changes or updates related to your property tax account.

By following these steps, you can easily register or update your mobile number and email ID with the Greater Chennai Corporation for all property tax related communications.