Linking your Aadhaar with your building in the Ksmart Property Tax Module is a straightforward process designed to streamline property management and tax services for citizens in Kerala.

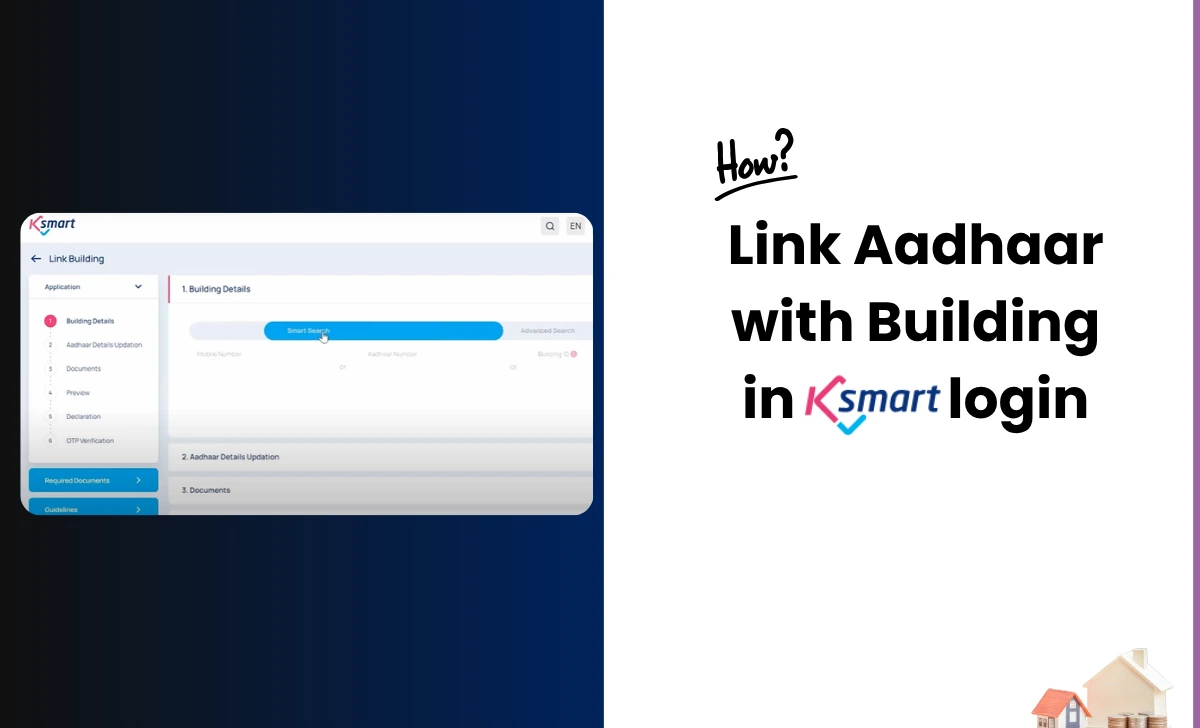

How to Link Aadhaar with Building in Ksmart

Here are the step by step instructions based on the available video and supporting sources:

- Visit the official Ksmart login at ksmart.lsgkerala.gov.in.

- Click on the Citizen Login option.

- Enter your registered mobile number or user credentials to log in as a citizen.

- Complete any OTP or authentication steps as prompted.

- locate the Property Tax section on the dashboard.

- Select the option to View or Manage Buildings linked to your account.

- Enter your Ward Number and Building Number in the provided fields.

- Click on the Search or Fetch Details button to retrieve your building information from the KSMART database.

- Click on the Link Aadhaar button next to your building details.

- Input your Aadhaar Number and the mobile number registered with Aadhaar.

- Submit the details.

- You may receive an OTP on your Aadhaar-linked mobile number for authentication.

- Enter the OTP to complete the verification process.

- Upon successful verification, the system will confirm that your Aadhaar linked to your building.

You can now access all services related to your property online, including tax payments and certificate generation.

What to do if building details are missing in Ksmart

If your building not listed in the KSMART database, visit the nearest Facilitation Center at the Corporation Main Office or Zonal Offices for assistance. Staff will help you add your building details and proceed with Aadhaar linking.

Benefits of Linking Aadhaar with Building in KSMART

- Unified Access: All services, including Kerala property tax payment and certificate requests, become available online.

- Transparency: Full access to property records, previous tax history, and building-related data.

- Efficiency: Eliminates the need for multiple manual applications, certificates generated automatically after linking.

- Reduced Corruption: Automated verification and processing ensure a transparent and efficient system.

By following these steps, you can efficiently link your Aadhaar with your building in the KSMART Property Tax Module using your citizen login, ensuring seamless access to all property-related services on the platform.