Paying your Telangana municipal property tax online has never been easier, but it’s now easy than expecting. The official Telangana eMunicipal portal offers a streamlined process for property owners to manage their tax obligations efficiently.

Whether you use your Telangana Property Tax Identification Number (PTIN) or by Door Number for Telangana property tax payment for any muncipality of any district, the platform ensures a hassle free experience for users across the state.

Process to Pay Telangana Municipal Property Tax Online

How to Pay Telangana Property Tax Using PTIN

The PTIN (Property Tax Identification Number) is a unique identifier assigned to every property, making it the most reliable method for tax payments. Here’s how you can pay:

- Visit the Official Website: Go to emunicipal.telangana.gov.in for telangana muncipal properties.

- Navigate to Property Tax Payment:

- On the homepage, locate the “Online Services” section.

- Click on “Property Tax (House Tax)” under “Pay Online.”

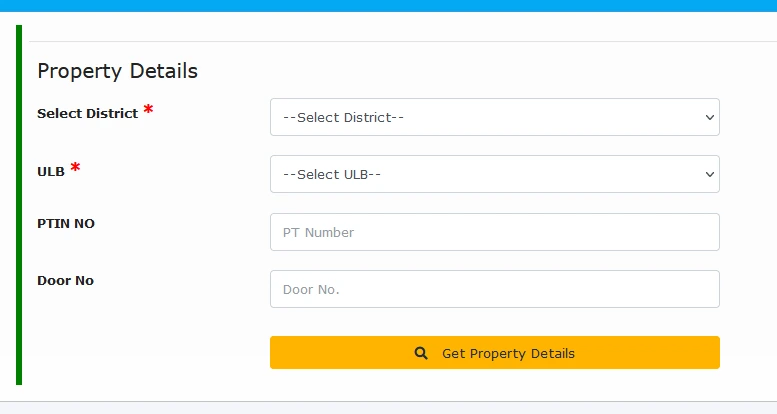

- Enter Property Details:

- Input your 10-digit Telangana PTIN or Assessment Number.

- Select your municipality or Urban Local Body (ULB).

- View Tax Details:

- Click “Search” to retrieve your property tax details.

- Verify the tax amount displayed.

- Proceed to Payment:

- Click “Pay Now” and choose your preferred payment method (Credit/Debit Card, Net Banking, UPI).

- Complete Payment:

- Confirm your transaction and save the receipt.

Steps for Payment of Telangana Property Tax Using Door Number

If you don’t have your PTIN handy, you can pay using your Door Number:

- Visit emunicipal.telangana.gov.in.

- Navigate to Online Payments > Property Tax

- Click “Property Tax Payment By Door No.”

- Enter your District, ULB, Door Number, and other relevant details.

- Fetch Property Details and Verify Dues.

- Proceed with Payment using available options.

- Save the receipt after successful payment.

The above said process is common for all the municipalities covered in all the 31 Districts: Adilabad, Bhadradri Kothagudem, Hanamkonda, Jagtial, Jangaon, Jayashankar Bhupalpally, Jogulamba Gadwal, Kamareddy, Karimnagar, Khammam, Komaram Bheem, Mahbubabad, Mahbubnagar, Mancherial, Medak, Medchal, Malkajgiri, Nagarkurnool, Nalgonda, Narayanpet, Nirmal, Nizamabad, Peddapalli, Rajanna Sircilla, Ranga Reddy, Sangareddy, Siddipet, Suryapet, Vikarabad, Wanaparthy, Warangal, Yadadri Bhuvanagiri.

For a detailed guide on paying GHMC property tax online, including step by step instructions and benefits, visit GHMC property tax online payment to ensure compliance and avoid penalties while managing your property taxes efficiently.

Common Issues and Solutions

- Incorrect Details: Double check PTIN or Door Number inputs, Use official portals to retrieve missing information.

- Payment Failures: Retry after verifying internet connectivity or use alternate payment methods, contact customer support if deductions occur without receipt generation.

- Receipt Not Found: Wait 24-48 hours for updates on the portal before rechecking.

Why Timely Payment Matters

Timely payment of municipal property taxes ensures uninterrupted civic services like sanitation, water supply, and road maintenance.

Avoid property tax penalties by adhering to deadlines and maintaining updated records. Paying Telangana municipal property tax online via PTIN or Door Number is a seamless process that empowers citizens with transparency and efficiency.

Utilize this guide to stay compliant and contribute to better urban infrastructure development across Telangana. This revised version incorporates verified facts while maintaining clarity and user-friendliness based on credible sources.