Now its easier to do PMC property tax online payment in this 2025 with Pune Municipal Corporation dedicated online portal.

This guide will help you understand the process, benefits, and essential details for timely PMC property tax payment while avoiding penalties.

PMC property tax is levied on residential, commercial, and institutional property tax within Pune’s municipal limits. The revenue collected funds civic amenities such as roads, water supply, waste management, and public infrastructure.

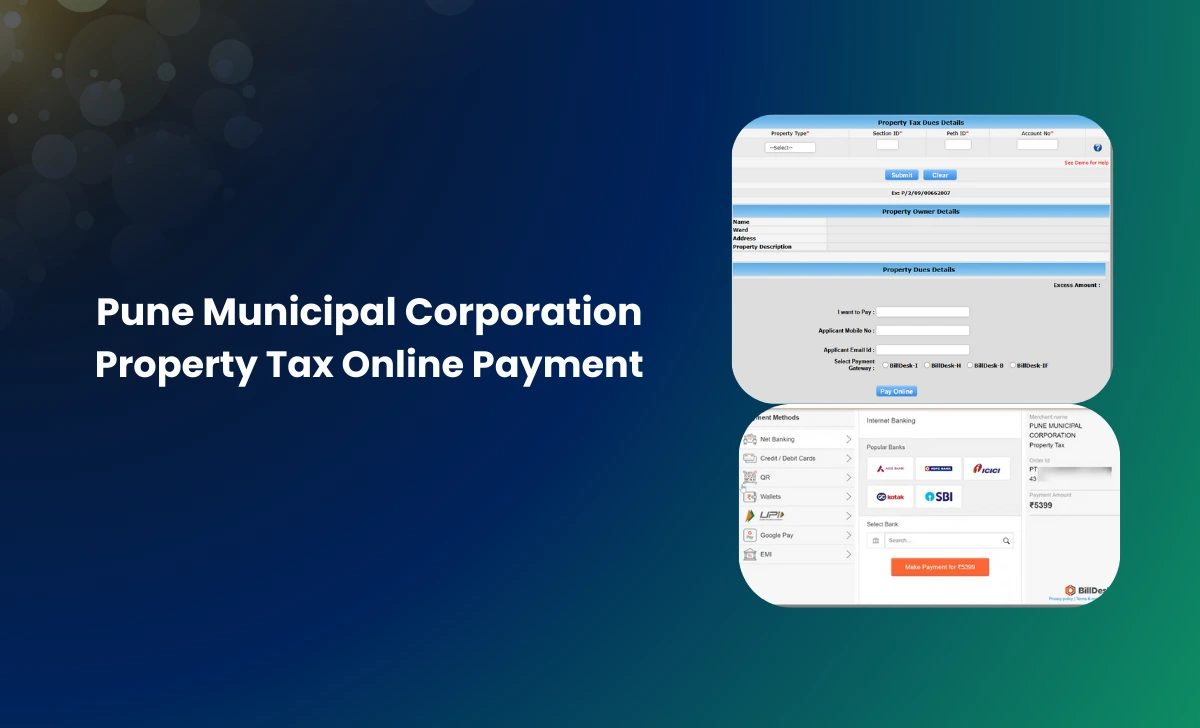

PMC Property Tax Online Payment Steps

Follow these simple steps to pay your PMC property tax online:

- Visit the PMC Property Tax online payment portal at propertytax.punecorporation.org

- Select your Property Type.

- Input your Section ID, Peth ID, and Account Number.

- Click on the Submit button to retrieve your property details.

- Check PMC Property tax bill by verifying Property Owner Details including Name, Ward, Address, Property Description.

- Enter Payment Details which you want to pay under “I want to Pay.”

- Provide your mobile number and email ID in the respective fields.

- Select Payment Gateway from available BillDesk options (BillDesk-I, BillDesk-H, BillDesk-B, or BillDesk-IF).

- Click on the Pay Online button.

- Proceed with payment using methods such as UPI, net banking, credit/debit card, or wallets.

- After successful payment, wait for 3 working days for transaction updates and Download your receipt from the portal.

Important Notes:

- Do not attempt the transaction twice if already completed, check your bank account for confirmation.

- For unresolved issues or errors on Pune property tax online payment, you may email the details to [email protected] with relevant details like Property ID and payment proof.

- If you want to make Partial payments, just you make in offline by visiting ward offices or partner banks.

- PMC property tax bills are distributed annually via post or can be downloaded from the PMC portal using your Property ID.

PMC Property Tax Offline Payment Options

For those who prefer traditional methods:

- Visit PMC ward offices or citizen facilitation centers.

- Payments can be made via cash, cheque, or demand draft.

- Partner banks like HDFC Bank, ICICI Bank, Cosmos Bank, and Bank of Maharashtra also accept payments over the counter.

Rebates and Penalties on Pune Municipal Property Tax Payment

PMC offers attractive rebates to encourage timely payments:

- A 40% rebate is available for self-occupied residential properties (you should check before payment for the offer).

- Additional discounts of 5%-10% are offered for early payments made before June 30 2025.

- Environmentally friendly properties may qualify for additional discounts.

- To claim these rebates, property owners must submit necessary documents such as voter ID or Aadhaar card along with the PT-3 form.

Late payments attract penalties:

- A 2% penalty per month applies on overdue amounts.

- Arrears incur an additional 2% monthly penalty.

- Education Cess unpaid within due dates incurs a 1% notice fee.

- Delays beyond six months may lead to legal action or restrictions on property transactions

How to Obtain Pune Corporation Property Tax No Dues Certificate after payment

To get a No Dues certificate:

- Submit an application online through the PMC portal.

- Alternatively, visit your ward office with proof of payment.

Conclusion: Paying your PMC property tax online ensures compliance with municipal regulations, Whether you choose online or offline methods, timely payment supports Pune’s development and keeps your finances in order.