The PMC Property Tax Receipt is an essential document for property owners in Pune, serving as proof of tax payment.

The Pune Municipal Corporation has made it easy for taxpayers to generate, download and print their Pune property tax payment receipt through its online portal.

This guide provides a step by step walkthrough, explains the receipt’s components, and addresses common issues taxpayers may face.

How to Generate PMC Property Tax Receipt Online

Follow these simple steps to download the receipt for your PMC property tax online payment transaction:

- Visit the Official Website using PMC property tax portal at propertytax.punecorporation.org.

- Navigate to the “Tax Receipt” Section

- Select your Property Type (e.g., residential or non-residential).

- Provide your Section ID, Peth ID, and Account Number in the respective fields.

- Click on Property Paid Detail to view your payment records.

- Identify and select the relevant challan number corresponding to your payment.

- Tap on “Click here to print receipt”, which generates a computer-generated receipt that does not require a signature.

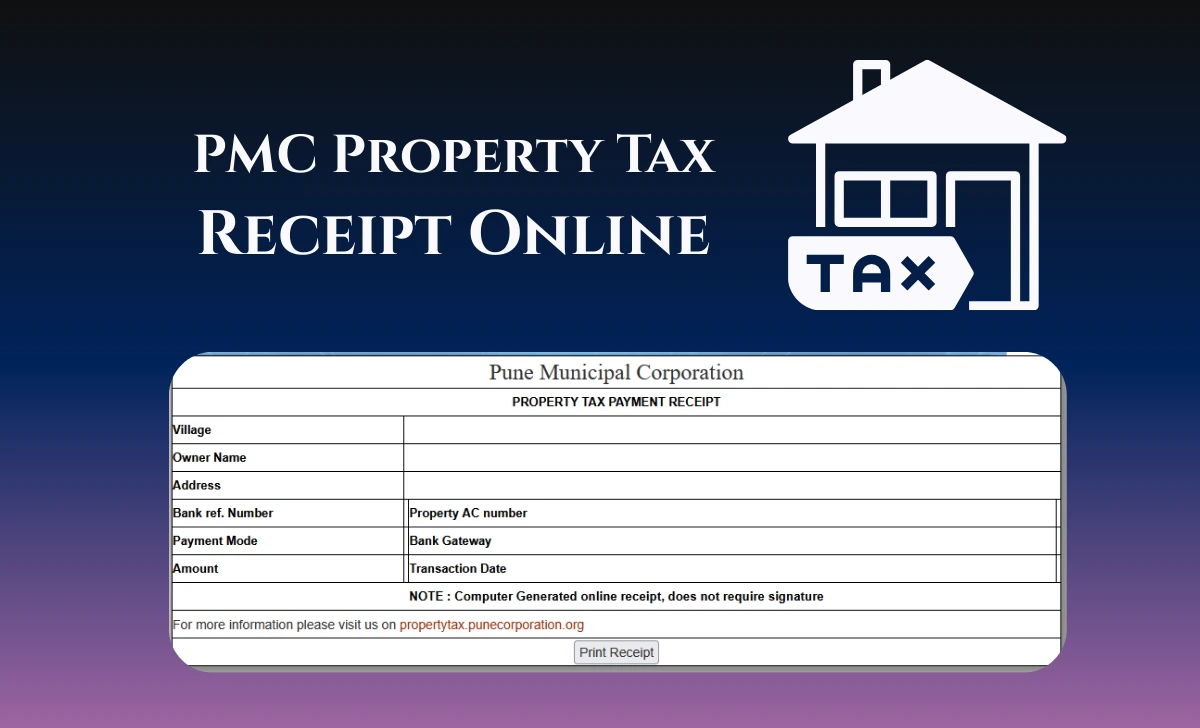

Pune Property Tax Receipt Components

The Pune property tax payment receipt contains vital details about your payment and property. Below is a breakdown of its fields:

| Field Name | Description |

|---|---|

| Village | The locality where the property is situated. |

| Owner Name | Name of the property owner. |

| Address | Address of the property. |

| Bank Reference Number | Reference number for payment verification. |

| Property Account Number | Unique account number for your property tax. |

| Payment Mode | Method used for payment (e.g., Bank Gateway). |

| Amount | Total amount paid for property tax. |

| Transaction Date | Date when the payment was made. |

Note: The receipt is computer-generated and does not require a signature.

The online platform for generating your property tax PMC receipt generation offers several advantages like

- Convenience

- Time Efficiency

- Digital Records

- Error Resolution

Common Issues and Troubleshooting Tips in Generating Pune Municipal Corporation Property Tax Payment Receipt

While generating receipts online is straightforward, users may encounter some issues with their PMC property tax receipt download. Here are the solutions to common problems:

- Incorrect Receipt Year Generated

- Ensure you select the correct challan number corresponding to the current fiscal year.

- If discrepancies persist, email the details (Property ID, Name, Payment Date, etc.) to [email protected].

- Payment Not Reflected on Portal

- Wait for up to three working days for transaction updates.

- If unresolved, contact PMC support with bank transaction details.

- System Glitches During Peak Times

- Retry during non-peak hours or visit a nearby ward office for assistance.

Conclusion: The PMC Property Tax Receipt is an indispensable document for taxpayers in Pune, ensuring compliance with municipal regulations and financial records. By leveraging Pune municipal corporation online platform, taxpayers can efficiently manage their payments and receipts while enjoying digital convenience.