Addressing civic issues such as property tax discrepancies, road maintenance, and sanitation concerns is now more efficient with the GHMC Grievance system.

Citizens can quickly file complaints and monitor their GHMC complaint status through the official complaint portal, ensuring transparency and timely resolutions.

How to File a GHMC Grievance for Property Tax Issues

Follow these steps to submit your grievance related to GHMC property tax payment and to check its complaint status:

Step 1: Visit the GHMC Website

- Open your browser and navigate to ghmc.gov.in

- Scroll down and go to e-Complaints sections

- Click Lodge Grievance to access the GHMC grievance cell form.

Step2: Enter Mobile Number and Validate OTP

- Provide your mobile number which will communicate for further transaction and status

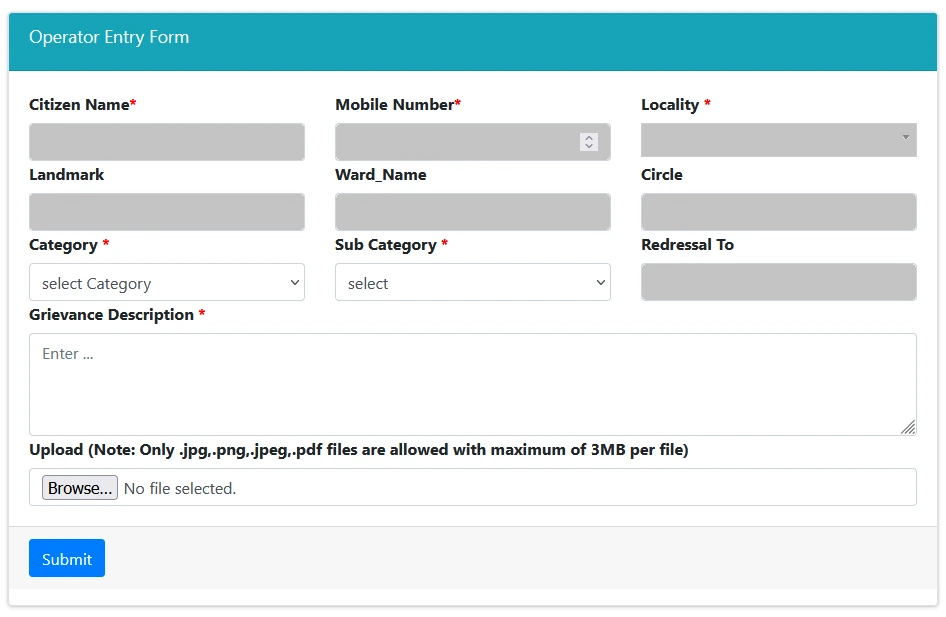

Step 3: Fill in the Operator Entry Form

You will see a form requiring detailed information. Complete it as follows:

- Citizen Name: Enter your full name as per your property tax.

- Locality: Select your locality from the drop down menu.

- Landmark: Provide a nearby landmark for identification.

- Ward Name & Circle: Fields will automatically load when selecting Locality

- Category: Select “Revenue (Property Tax)” from the dropdown list.

- Subcategory: Choose the relevant subcategory

- Payment not updated

- Interest / penalty adjustment

- Change of Name mutations

- New Assessment of Property tax

- Assessment of Vacant Land

- Correction of Door Number / Address

- Correction of Property Tax

- Mutation of Property

- Vacany Remission / Exemption

- GIS Mobile Verification

- Grievance Description: Clearly describe your issue in detail which delivers exactly about your issue.

Step 4: Upload Supporting Documents

Attach any relevant files, such as property tax receipts or notices. Ensure that:

- File formats are .jpg, .png, .jpeg, or .pdf.

- File size does not exceed 3 MB.

Step 5: Submit Your Grievance

After completing all fields, click on the “Submit” button at the bottom of the form. A unique Complaint ID will be generated for tracking purposes. Make sure to save this ID for future reference.

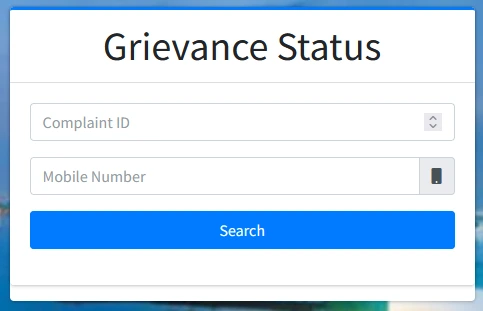

How to Check GHMC Grievance Status

After submitting your grievance, you can easily check the GHMC complaint status and stay updated on the resolution process.

Step 1: Access the Grievance Status Section

- Open GHMC website https://www.ghmc.gov.in/#

- Navigate to the Enquiry > Grievance > Status or Login with the same as above

Step 2: Search for Your Grievance

You can perform a GHMC complaint status check using one of two methods:

- Search with Complaint ID: Enter the Complaint ID you received after submitting your grievance and click “Submit.”

- Search with Mobile Number: Enter your registered mobile number and click “Submit.”

Step 3: View Status Updates

The system will display updates regarding your grievance, including its current status and any resolutions provided by GHMC officials.

The GHMC grievance cell is dedicated to resolving issues specifically within the Greater Hyderabad region, especially those related to property tax.

By utilizing the GHMC Grievance system and regularly checking your GHMC grievance status, you can ensure your civic concerns are addressed efficiently through the robust mechanisms provided by ghmc.gov.in complaint portal.