Now GHMC property tax pay online is easier than ever for Hyderbad property owners, thanks to the digital initiatives of the Greater Hyderabad Municipal Corporation (GHMC).

This comprehensive guide will help you understand every aspect of GHMC property tax pay online, including step by step instructions, payment options, how to check dues, and tips for both local and international property owners.

GHMC property tax is a municipal levy imposed on property owners within the Greater Hyderabad area. It funds essential civic services and infrastructure. Timely GHMC property tax payment is crucial to avoid penalties and support city development.

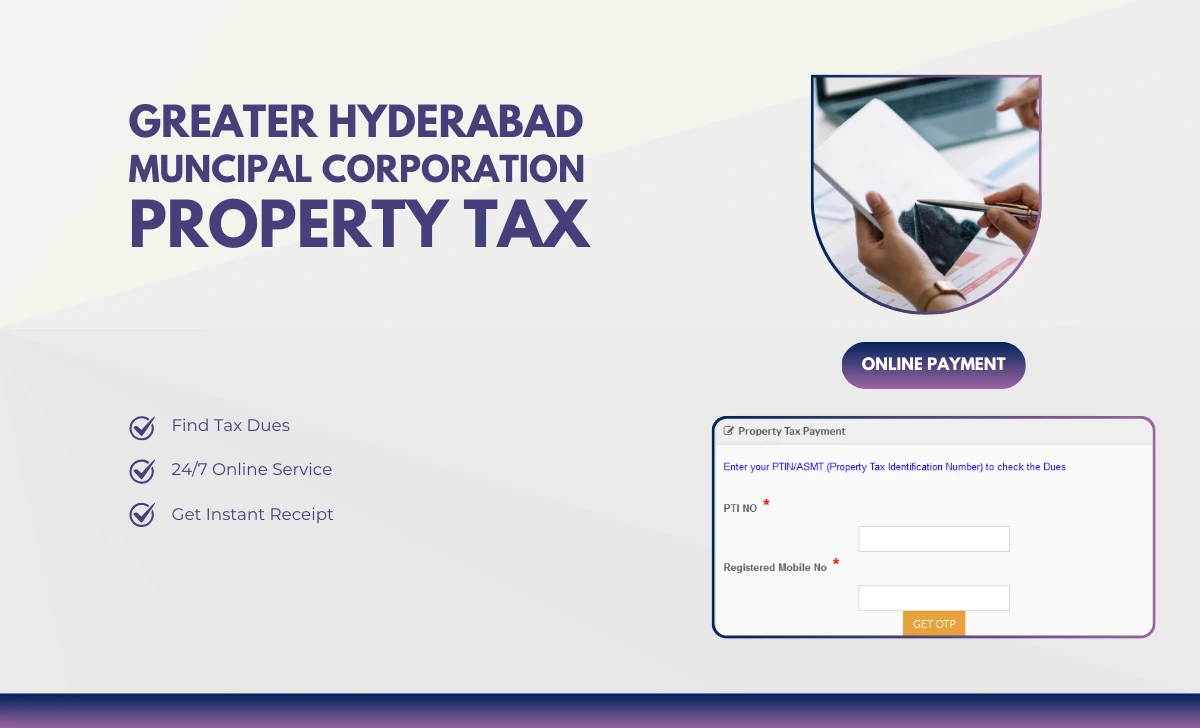

Steps for GHMC Property Tax Pay Online

The below is the secure and convenient process for GHMC property tax pay online, so just check how you can complete your payment from anywhere:

Step 1: Visit the Official GHMC Payment Portal using onlinepayments.ghmc.gov.in

- Go to the Greater Hyderabad Municipal Corporation’s official website and click on the “Property Tax Payment” option under the “Online Payments” menu.

Step2: Enter Your PTIN

- Input your GHMC PTIN to access your property details, and if you don’t know Property Tax Identification Number, use the search by mobile number or property details feature.

Step 3: Check GHMC Property Tax Dues

- Click on “Know Property Tax Dues” to see your outstanding GHMC property tax dues. The portal displays current and previous arrears allowing for GHMC property tax payment online.

Step4: Verify Tax Details

- Confirm your property details and tax amount.

- Look for the GHMC property tax early bird offer 2025: Pay by May 31st, 2025, and get a 5% rebate.

Step 5: Choose Payment Method

- Select from various GHMC property tax payment options which allow: debit/credit cards, net banking, UPI, wallets, or the GHMC property tax app.

Step6: Complete Payment

- Enter your payment details and submit.

- You’ll receive a confirmation for your GHMC property tax online payment.

Step 7: Download Receipt

- After successful payment, download or print your GHMC property tax receipt for future reference from the same portal.

Alternative Platforms for GHMC Property Tax Payment Online Hyderabad

- Paytm: Go to Municipal Payments > Greater Hyderabad Municipal Corporation, enter your PTIN, and proceed.

- GHMC Property Tax App: Use the official app for hyderabad property tax payment and to check GHMC property tax dues.

- Third-party portals: Some banks and digital wallets also support GHMC online property tax payment.

How to Check GHMC Property Tax Dues & Arrears

- Visit onlinepayments.ghmc.gov.in or the GHMC website property tax section.

- Enter your PTIN or use the GHMC property tax search by mobile number.

- Review your property tax GHMC payment history, arrears, and make payments as needed.

GHMC Property Tax Payment (options)

- Net Banking

- Credit/Debit Cards

- UPI

- Mobile Wallets

- GHMC property tax app

- Offline at GHMC offices or MeeSeva Centers

Special Features and Offers:

- Concessions: Senior citizens, differently abled, and charitable institutions may be eligible for rebates (submit documents at GHMC office).

Frequently Asked Questions on GHMC Property Tax

How to pay GHMC property tax online if I’m outside India (e.g., USA)?

- Use the official portal onlinepayments.ghmc.gov.in or trusted apps. International cards and net banking are accepted. Ensure your bank allows international transactions.

Can I pay GHMC property tax for previous years?

- Yes, all prvious arrears and dues are shown when you enter your PTIN, where the system will display outstanding dues, including penalties and interest.

What if I don’t receive a payment confirmation?

- Check your bank statement, then log in to onlinepayments.ghmc.gov.in and verify under “Payment History”, If unresolved, contact GHMC support.

Can I pay for multiple properties in one go?

- Each property requires a separate transaction using its unique PTIN.

How to update my mobile number for GHMC property tax payment online Hyderabad?

- Visit the nearest GHMC office for assistance if you cant update online.

GHMC Property Tax Payment Online Tips for International Property Owners

- Time Zone Awareness: Remember the Indian tax deadlines (July 31, October 15, and early bird by April 30), even you are staying in USA, UAE, Canada, UK or from any where across the world, upto to have your property in India under GHMC area.

- International Payments: Ensure your card/bank supports INR transactions.

- Keep Digital Records: Download receipts for every GHMC property tax online payment for future reference or legal needs.

- Contact Support: Use email or helplines provided on [ghmc.gov.in property tax] for any cross-border payment issues.

Conclusion: The GHMC property tax pay online system is designed for ease, security, and transparency. Whether you’re in Hyderabad or abroad, timely GHMC property tax payment through official channels like onlinepayments.ghmc.gov.in, the GHMC property tax app, or trusted third party platforms ensures you stay compliant and avoid penalties. Always check your GHMC property tax dues, use the early bird offer, and keep your payment receipts safe.

dear Sir/madam

I am not able to get my property tax detials as my mobile number is not registered to PITN. how to change new mobile number since i do not have the existing mobile number.

kindly do you your needful in this regard.

You are requested to approach concerned property tax authorities to change your registered mobile number by submitting the necessary request, where online change process is not possible for you becoz, you are not having the existing registered number, so please approach the concerned office and change immediately.

Unable pay GHMC PROPERTY TAX ONLINE from U.S.