Understanding how to do mutation of property in Telangana is crucial for every property owner, especially when transferring ownership due to sale, inheritance, or gift.

Mutation of property in Telangana municipalities ensures to update your name in municipal records, which is vital for property tax compliance and legal ownership.

This guide explains how to apply for mutation online and offline, required documents, and how to check cdma telangana mutation status.

In Telangana, the mutation process streamlined with online systems like the CDMA portal and Dharani portal, making it easier for applicants.

How to Apply Mutation Online in Telangana

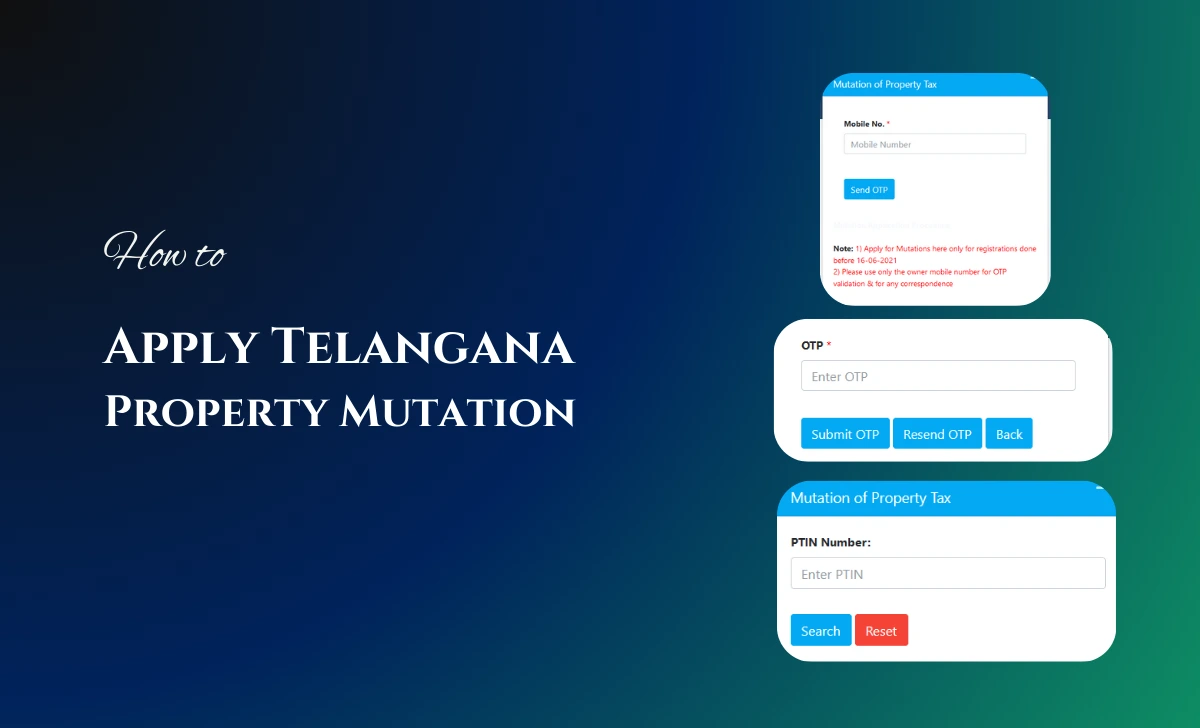

The Telangana government has simplified how to apply for mutation online through the CDMA portal. Here’s the step-by-step process:

- Visit the CDMA Telangana Portal: Go to the official webpage of the Commissioner & Director of Municipal Administration (CDMA) using https://cdma.cgg.gov.in/CDMA_PT/Mutation/Index.

- Select Mutations Under Online Services: Navigate to the ‘Mutations’ option in the online services menu.

- Authenticate with Mobile OTP: Enter your mobile number to receive an OTP. Use the owner’s number for validation.

- Fill the Mutation Application Form Telangana: Enter accurate property and owner details.

- Upload Required Documents: Attach scanned copies of all necessary documents.

- Pay the Mutation Fee: Make the payment online (net banking, credit/debit card)

- .Submit and Acknowledge: Submit the application and save the unique application number for tracking.

Note: Online mutation is available for registrations before June 16, 2021. For recent registrations, mutation is integrated with property registration.

After completion, use your unique application/request number and get mutation certificate download from Telangana CDMA portal.

This process is applicable only for Telangana state municipalities and corporations other than GHMC, and for detailed steps specific to Hyderabad, refer to the guide How to Apply GHMC Property Mutation.

Telangana State Municipality Offline Mutation Application Process

- Download or Collect Mutation Application Form Telangana.

- Fill the Form.

- Attach Documents.

- Submit at Municipal Office.

- Pay the Mutation Fee.

- Authorities will verify the property and documents.

- Once approved, mutation entry is made in records and you receive the mutation certificate Telangana.

Documents Required for Property Mutation in Telangana

To apply for property mutation, ensure you have the following documents ready:

- Duly filled mutation application form Telangana

- Attested copy of sale deed, gift deed, or partition deed

- Latest encumbrance certificate

- Aadhaar card of the applicant

- Up-to-date property tax receipt

- Non-judicial stamp paper for affidavits

- Notarized indemnity bond and affidavit

- Death certificate, succession certificate, or legal heir certificate Telangana photos (if applicable)

- Demand Draft for mutation fee (0.1% of market value; minimum Rs.800 in municipalities)

Timeline for Telangana Property Mutation Completion

As per Telangana government guidelines, the mutation process under Revenue (LA), MA&UD, I&C PR&RD departments will be completed as

- Online: Usually within 14-15 days if all documents are correct.

- Offline: May take up to 30-45 days, depending on verification.

Property Mutation Fees in Telangana Municipality

The mutation fee is calculated as 0.1% of the market value of the property, with a minimum fee of Rs. 800 for non-agricultural properties.

Your may check this for different ULB’s using Telangana Property Mutation Fee Calculator in online

example calculation:

- If your property’s market value is Rs. 10,00,000, your mutation fee will be Rs. 1,000 (0.1% of Rs.10,00,000).