The early bird rebate for Telangana house property tax 2025 is a golden opportunity for property owners to save money by paying their taxes early.

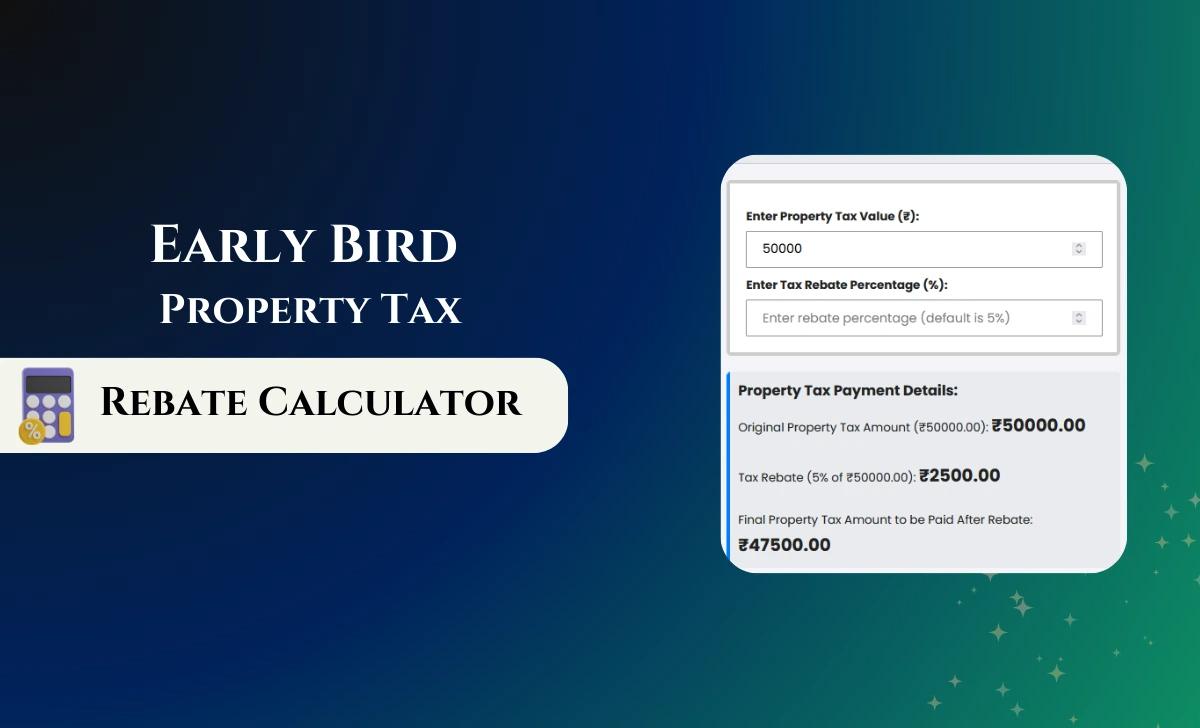

This scheme, introduced by the Greater Hyderabad Municipal Corporation (GHMC), offers a 5% rebate on Telangana property tax payments made before May 31st, 2025, let’s check the discount and final tax to be paid on calculator

Telangana State Early Bird Property Tax Payment Rebate Calculator

Whether you own a residential or commercial property, understanding the benefits and process of this scheme can help you avoid penalties and maximize savings.

What is the Early Bird Rebate Scheme?

The GHMC early bird scheme for commercial property tax 2025 and residential properties is designed to encourage taxpayers to pay their dues promptly.

This initiative applies to both house and commercial property taxes for the financial year 2024-25. However, it is important to note that the rebate is only applicable to the current year’s tax and not on arrears from previous years.

Eligibility Criteria for Availing the Rebate

To avail of the early bird rebate on Telangana property tax 2025, taxpayers must meet the following conditions:

- The payment must be made before May 31st, 2025.

- The rebate applies to both residential and commercial properties registered under GHMC.

- Taxpayers must ensure there are no pending arrears from previous years.

By meeting these criteria, you can easily claim your GHMC property tax online payment for early bird discount 2025.

How to Calculate GHMC Property Tax for Residential and Commercial Properties to get Tax Rebate

Understanding how GHMC calculates property tax is crucial for accurate payments. The GHMC property tax calculation for residential and commercial properties is based on the Annual Rental Value (ARV) of your property.

For residential properties, the ARV is determined by multiplying the monthly rental value by 12 months. For commercial properties, additional factors such as location and type of business are considered.

By using the GHMC property tax online calculator, you can estimate your taxes and ensure timely payments to benefit from the early bird rebate for Telangana house property tax 2025.

To pay your Telangana property tax before My 31st, 2025, you can use the GHMC property tax online payment system for Hyderabad properties or the Telangana eMunicipal portal for municipalities.

Both platforms offer streamlined processes, whether using your PTIN or Door Number, ensuring a hassle-free experience for timely compliance. For detailed steps, explore GHMC Property Tax Online Payment and Telangana Municipal Property Tax Payment.

Benefits of GHMC Early Bird Scheme for Hyderabad Properties

The benefits of GHMC early bird scheme for Hyderabad properties go beyond just financial savings. Here’s what you gain:

- A flat 5% rebate on Telangana property tax payment deadline for early bird rebate.

- Avoidance of penalties or interest charges for late payments.

- Hassle-free online payment options that save time and effort.

- Contribution to better civic amenities funded by timely tax collection.

This scheme ensures that taxpayers not only save money but also support urban development in Telangana.

Penalties for Late Payment of GHMC Property Tax in Telangana

Failing to pay GHMC property tax on time can result in a 2% monthly penalty on outstanding dues, which accumulates until cleared. For a detailed breakdown of due dates, penalties, and ways to avoid fines, refer to GHMC Property Tax Due Dates and Penalties.

Key Takeaways: Why You Should Pay Property Tax Early

The early bird rebate for Telangana house property tax 2025 is more than just a financial incentive, it’s an opportunity to simplify your tax obligations while contributing to community development.

By paying before April 30, you ensure compliance with government policies, avoid penalties, and enjoy significant savings.Whether you’re a homeowner or a business owner, taking advantage of this scheme is a smart financial move that benefits both you and your city.

In conclusion, don’t miss out on the chance to save with the early bird rebate on Telangana house and commercial property tax in 2025 by paying before 31st May through convenient online platforms.

Great measure