The comprehensive platform ULB haryana property tax designed to streamline property tax management in the state.

ULB Haryana offers a user-friendly interface for citizens and NRIs to register, log in, and manage their property tax dues efficiently. This article will guide you through the registration and ULB haryana login processes, highlighting its benefits.

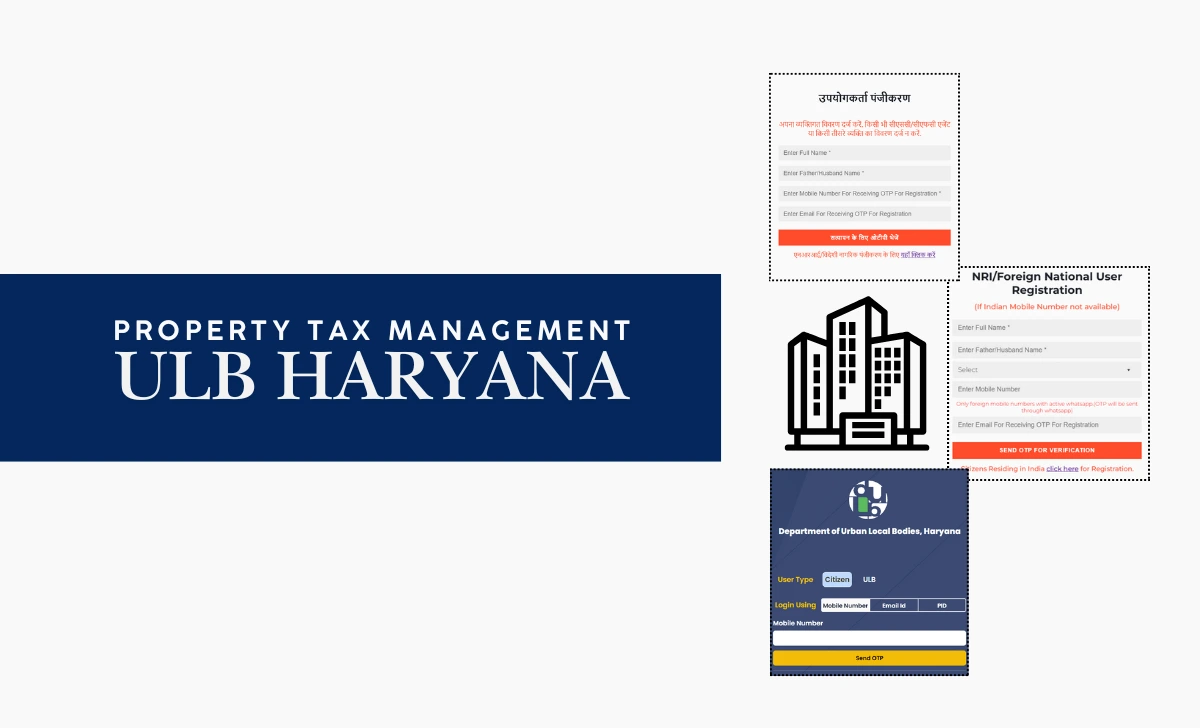

ULB Haryana Property Tax Portal Registration Process

To register on property tax Haryana portal, follow these steps to get activiate the ULB haryana login tailored for Indian citizen and NRI without an Indian mobile number.

- Visit ULB Haryana portal: Open your internet browser and navigate to property.ulbharyana.gov.in.

- New User Registration: Click on the “New User Registration” button for citizens or “NRI/Foreign National Registration” for NRIs.

- Enter Details:

- For Citizens: Provide your name, father/husband’s name, and mobile number. Entering an email ID is optional but recommended for additional verification.

- For NRIs: Enter your mobile number and email ID. If you don’t have an Indian mobile number, OTPs may sent via WhatsApp to your foreign mobile number and email ID to complete the NDC Haryana NRI Registration Process.

- OTP Verification: Click on “SEND OTP FOR VERIFICATION.” An OTP may sent to your mobile number and email ID (if provided).

- Complete Registration: Enter the OTP and click on “Register” to complete the process.

This process ensures that Indian citizens and NRIs can easily register and manage their property taxes remotely through the ULB Haryana to get the authorized outcome..

ULB Haryana Login

After registering as above, you can log in using one of three options:

- Mobile Number: Enter your mobile number, and an OTP may sent to it.

- Email ID: Enter your email ID, and an OTP may sent to it.

- PID (Property ID): If you have a PID, you can log in using it, an OTP sent to the registered mobile number.

The ULB haryana login process is similar for both citizens and NRIs, with the option to use an email ID being particularly useful for NRIs without an Indian mobile number.

Facilities of ULB Haryana NDC

The NDC Portal offers several facilities that benefit both Indian property owners and NRIs:

- Property Tax Payment: Users can pay property taxes online using various payment methods like net banking, credit/debit cards, or UPI, making it convenient for NRIs to manage their properties remotely. For a similar experience in other regions, you can explore the Punjab Property Tax Online Payment process.

- No Dues Certificate (NDC): Property owners can obtain and verify their No Dues Certificate, which is essential for property transactions and legal compliance.

- Property ID Management: Users can generate, update, and verify their unique Property IDs online, ensuring accurate property records.

- Document Verification and Updates: The platform allows users to update and verify their property documents, ensuring that all information is current and accurate.

Effective property tax management is crucial for financial planning. Platforms like the ULB harayana login help streamline these processes, making it easier for property owners to manage their finances.

For NRIs, managing property in Haryana involves understanding local regulations and leveraging digital platforms like the ULB haryana.

NRIs can purchase and own residential and commercial properties in India, but they must comply with FEMA regulations and RBI guidelines.

The ULB haryana login simplifies property tax management for NRIs by providing an online platform for registration, login, and payment of property taxes, ensuring compliance with Indian laws.

Financial Benefits and Incentives of ULB Haryana

The ULB haryana NDC offers several financial incentives for property owners.

For instance, there was a one-time rebate upto 15% on property tax arrears as and when announcement for those who cleared their dues and self-certified their property information by December 31.

Additionally, a 100% waiver of interest on pending arrears was available for those who met the same criteria.

In conclusion, the ULB Haryana property tax portal is a valuable resource for property owners in Haryana, offering streamlined registration and login processes along with financial incentives for timely tax payments, thus enhancing overall property tax management.