Paying your GHMC property tax payment is now seamless, thanks to digital advancements by the Greater Hyderabad Municipal Corporation (GHMC).

This guide covers every aspect of GHMC property tax pay online, including payment steps, checking dues, payment options, and tips for both local and international property owners.

GHMC property tax is a municipal charge levied on property owners within Hyderabad. Timely GHMC property tax payment is essential to avoid penalties and contribute to city development.

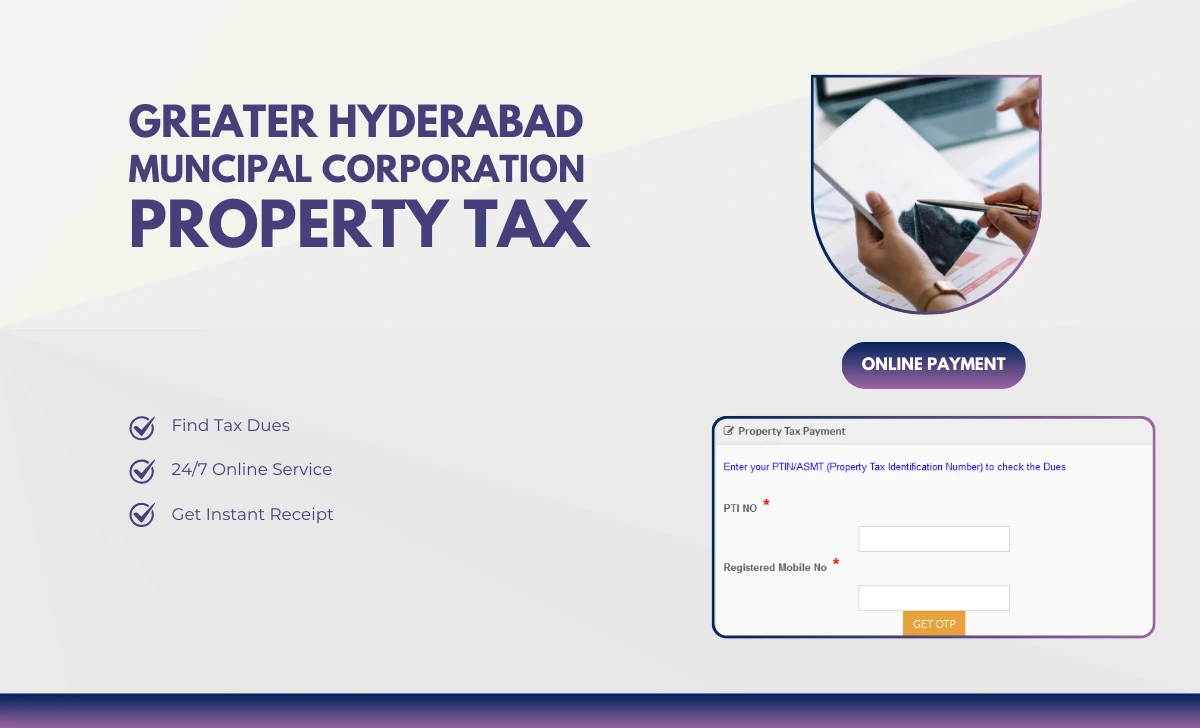

GHMC Property Tax Pay Online

- Go to onlinepayments.ghmc.gov.in or the GHMC website.

- Click on the Property Tax Payment option under the Online Payments menu.

- Input your GHMC PTIN (Property Tax Identification Number) to access property details.

- If you don’t know your PTIN, use the search by mobile number or property details feature.

- Click Know Property Tax Dues to view outstanding GHMC property tax dues to know current and previous arrears, for making payment online transparent.

- Confirm property details and tax amount (Look for the ghmc property tax online payment early bird offer or any other discounts at the time).

- Select from various GHMC property tax payment options: debit/credit cards, net banking, UPI, wallets, or the MyGHMC app.

- Enter payment details and submit. You’ll receive confirmation for your GHMC property tax online payment.

- After successful GHMC property tax payment, download or print your print your receipt for future reference.

Alternative Platforms for GHMC Property Tax Payment Online Hyderabad

- Paytm Payment: Go to Municipal Payments > Greater Hyderabad Municipal Corporation, enter your PTIN, and proceed.

- GHMC Property Tax App: Use the official MyGHMC app for GHMC hyderabad property tax online payment portal and to check property tax dues.

- Third-party Portals: Some banks and digital wallets support ghmc property tax payment online hyderabad.

How to Check GHMC Property Tax Dues & Arrears

- Visit onlinepayments.ghmc.gov.in or the GHMC website property tax section.

- Enter your PTIN or use the ghmc property tax search by mobile number.

- Review your ghmc property tax payment history, arrears, and make payments as needed.

GHMC Property Tax Payment Options

| Payment Mode | Availability |

|---|---|

| Net Banking | Yes |

| Credit/Debit Cards | Yes |

| UPI | Yes |

| Mobile Wallets | Yes |

| GHMC Property Tax App | Yes |

| Offline at GHMC/MeeSeva | Yes |

Special Features and Offers

- Concessions: Senior citizens, differently-abled, and charitable institutions may get rebates (submit documents at GHMC office).

- Interest Waiver: For 2025, pay by March 31 to get a 90% interest waiver on accumulated dues; pay only principal + 10% interest.

How can international owners pay GHMC property tax online?

- Use onlinepayments.ghmc.gov.in or trusted apps, where International cards and net banking are accepted, so please ensure your bank supports INR transactions.

Can I pay for previous years GHMC property tax dues?

- Yes, all previous arrears and dues are shown when you enter your PTIN, including penalties and interest.

What if I don’t receive a payment confirmation?

- Check your bank statement, then log in to onlinepayments.ghmc.gov.in and verify under Payment History. If unresolved, contact GHMC support.

Can I pay for multiple properties in one go?

- Each property requires a separate transaction using its unique PTIN, so using the PTIN, you can pay each transaction separetely.

Conclusion: The GHMC property tax payment system is designed for ease, security, and transparency. Whether you’re in Hyderabad or abroad, timely ghmc property tax pay online through official channels like onlinepayments.ghmc.gov.in, the GHMC property tax app, or trusted third-party platforms ensures compliance and helps you avoid penalties.

Always check your GHMC property tax dues, use the early bird offer, and keep your payment receipts safe for your GHMC property tax payment records.

dear Sir/madam

I am not able to get my property tax detials as my mobile number is not registered to PITN. how to change new mobile number since i do not have the existing mobile number.

kindly do you your needful in this regard.

You are requested to approach concerned property tax authorities to change your registered mobile number by submitting the necessary request, where online change process is not possible for you becoz, you are not having the existing registered number, so please approach the concerned office and change immediately.

Unable pay GHMC PROPERTY TAX ONLINE from U.S.