The GHMC property tax receipt is a vital document for property owners in Hyderabad, serving as proof of tax payment. Whether for legal purposes, financial records, or property transactions, downloading this receipt is essential.

This guide explains the GHMC tax receipt download process, including step-by-step instructions, troubleshooting tips, and key details for 2025.

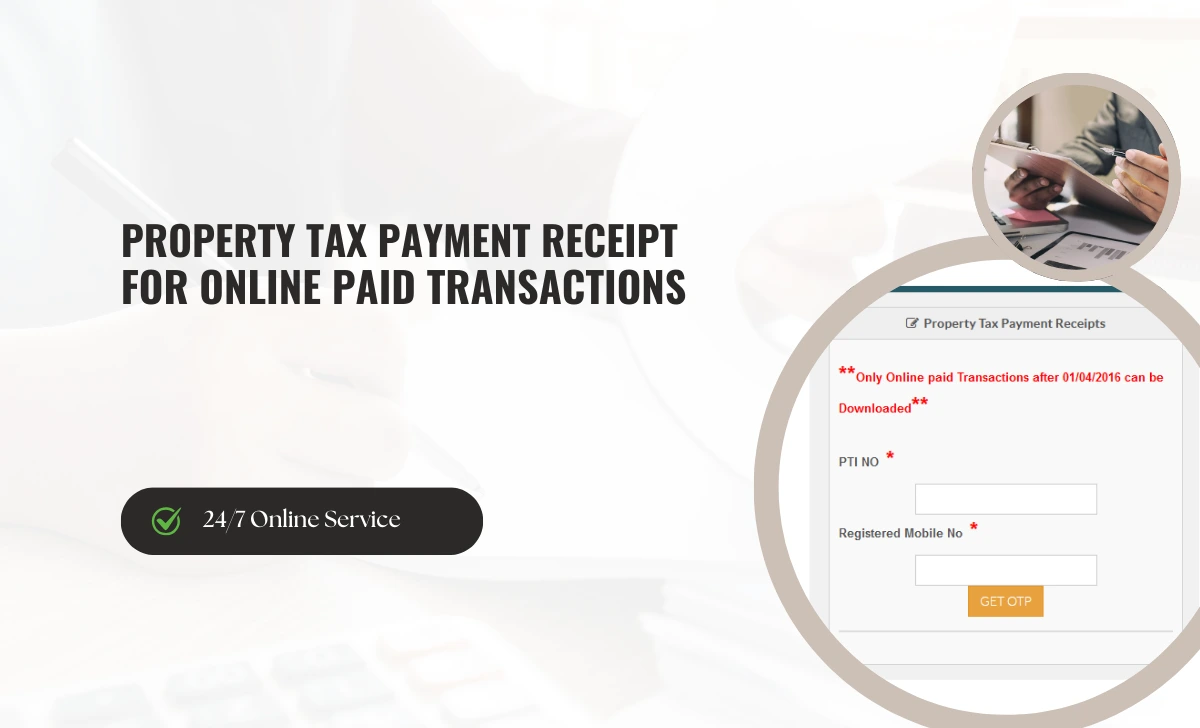

How to Download GHMC Property Tax Receipt Online

The GHMC property tax receipt download pdf process is simple and can be done through the official GHMC portal. Follow these steps:

- Visit the Official Website

- Go to the GHMC property tax portal at onlinepayments.ghmc.gov.in

- Access “Print Receipts”

- Navigate to the “Print Receipts” option under the “Property Tax” section.

- Enter PTIN Details

- Input your Property Tax Identification Number (PTIN), which is unique to each property owner.

- Verification

- Provide your registered mobile number and enter the OTP sent to your phone for verification.

- Display and Download Receipt

- Click “Display Receipt” to view the details of your GHMC property tax payment.

- Save the receipt as a PDF or print it directly for future use.

This process applies to online payments made after April 1, 2016, ensuring easy access to your receipts anytime.

Steps for GHMC Property Tax Receipt Download PDF for Specific Year

If you need a copy of your payment receipt for a specific year or have misplaced it, follow these steps:

- Visit the GHMC website and click on “Search Property Tax.”

- Enter details like GHMC PTIN, owner name, or door number.

- Solve the captcha code for verification and click “Search.”

- Select the relevant year from the displayed records of GHMC and download pdf receipt.

Key Features of GHMC Property Tax Receipt Download Process 2025

- Eligibility: Available only for GHMC property tax online payment made after 2016.

- Requirements: PTIN and registered mobile number are mandatory.

- Convenience: Instant generation of receipts upon successful payment verification.

Troubleshooting Issues with GHMC Property Tax Receipt Download

Sometimes, users encounter difficulties while accessing their Greater Hyderabad municipal corporation property tax receipt. Here are common issues and solutions:

- Receipt Not Found: Ensure you’ve entered the correct PTIN and payment details. If errors persist, contact GHMC support.

- Incorrect Details on Receipt: Verify all property-related data before downloading.

- Delayed Receipt Generation: Wait 24-48 hours after making the payment before attempting to download.

- Website Access Issues: Clear browser cache or use a different browser/device if you face technical glitches.

Can I download Greater Hyderabad municipal corporation property tax receipt for offline payments?

No, receipts for offline payments must be collected from MeeSeva centers or Citizen Service Centers in Hyderabad.

Can I update my mobile number linked to my property?

Yes, visit the GHMC mobile update page on their website to update your GHMC registered mobile number by entering your PTIN.

Benefits of Downloading GHMC Property Tax Payment Receipt PDF copy

- Serves as legal proof of tax payment during property transactions.

- Helps in claiming deductions under income tax laws.

- Useful for resolving disputes related to property ownership or taxation.

Conclusion:

The GHMC property tax payment receipt download process has been streamlined for convenience in 2025, allowing Hyderabad residents to access their receipts easily through the official portal.

By following this Hyderabad property tax receipt guide, you can retrieve, verify, and print your receipts hassle-free. Ensure you retain your PTIN securely and always verify details during payment to avoid complications when downloading your GHMC property tax receipt.