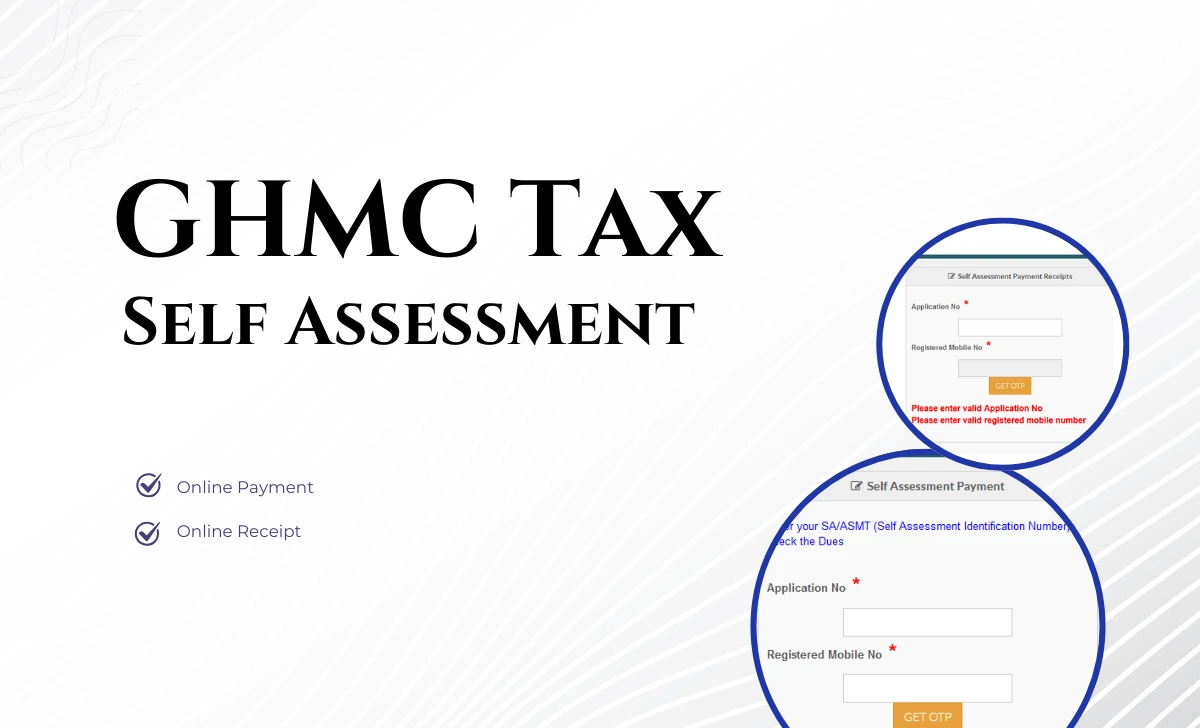

The GHMC Self Assessment system, introduced by the Greater Hyderabad Municipal Corporation (GHMC), is a streamlined online platform for property owners to calculate and pay GHMC property tax due amounts.

This initiative simplifies tax compliance for both residential and commercial property owners, ensuring transparency and convenience.

GHMC Self Assessment Online Payment Steps

Paying your property tax online through the portal for GHMC property tax self assessment is simple and efficient. Below is the detailed process:

- Visit GHMC self assessment payment portal using ghmc.gov.in/SA/ShowSA_Main

- Provide your Application Number or registered mobile number

- Click Submit and Get OTP.

- Input the OTP and review your property details, including arrears, taxable amount, and modifications.

- The system automatically calculates your tax liability based on property specifics.

- Choose a payment method (Net Banking, Debit/Credit Card, UPI).

- Click “Pay Now” to complete the transaction securely.

- Save or print GHMC tax receipt for future reference.

This step by step process ensures you can complete your GHMC property self assessment online payment without any hassle.

GHMC Property Tax Assessment Payment Receipt

After completing your GHMC property self assessment online payment, you can easily download or print your receipt using the following steps:

- Visit the official GHMC Self Assessment Print Receipt page by using ghmc.gov.in/SA/PrintSA_Receipt

- Enter your Application Number or your registered mobile number and Submit

- Get OTP > Provide OTP and Validate

- Search to retrieve your payment information.

- Review the displayed GHMC Self Assessment Payment Receipt and click Download or Print to save it.

This ensures you have a record of your payment for future reference.

Deadlines and Penalties:

- Property taxes must be paid biannually by July 31st and October 15th each year.

- A penalty of 2% per month is levied on delayed payments.

By adhering to these deadlines and using the efficient GHMC self assessment online payment platform, you can avoid penalties while contributing to Hyderabad’s infrastructure development.