The GHMC Vacant Land Tax calculator helps Hyderabad property owners determine their vacant land tax liability by applying 0.5% of the land’s capital value, as mandated by the Greater Hyderabad Municipal Corporation (GHMC).

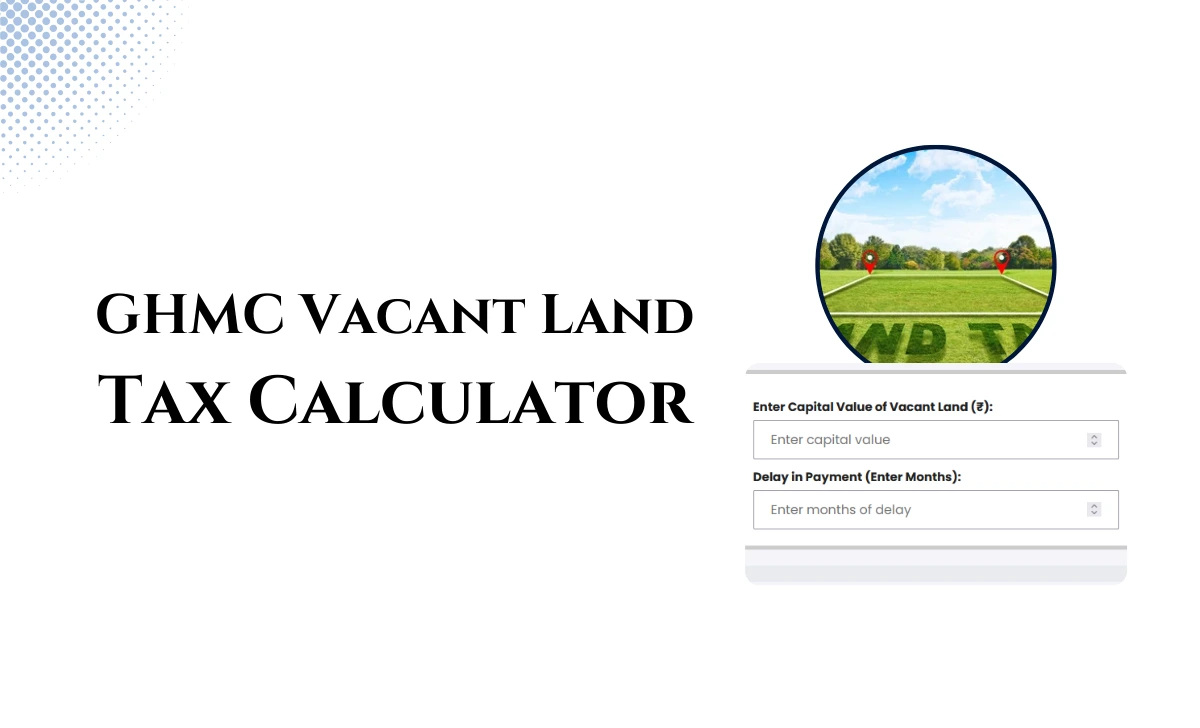

This guide explains the process, required documents, penalties for late payment, and the latest digital enhancements for 2025. Here’s a simple calculator and explanation of its usage.

GHMC Vacant Land Tax Calculator

The GHMC VLTIN stands for Vacant Land Tax Identification Number, which is a unique identifier assigned by the Greater Hyderabad Municipal Corporation to each vacant land property for taxation purposes.

Vacant Land Tax (VLT) imposed by GHMC on open plots that may not used for agriculture or are not appurtenant to buildings.

The tax calculated at 0.5% of the government-assessed capital value of the land, ensuring urban land utilization and revenue for civic services.

How to Calculate GHMC Vacant Land Tax

Formula: Vacant Land Tax = 0.5% × Capital Value of Vacant Land

Example:

If your vacant plot’s capital value is Rs. 20,00,000:

Vacant Land Tax = 0.5% × Rs. 20,00,000 = Rs.10,000 per annum

Late Payment Penalty: A penalty of 2% per month is charged on overdue amounts until cleared

2025 Digital Enhancements: Instant Assessment and VLTIN

GHMC has introduced a streamlined, citizen-friendly online system for property and vacant land tax assessment.

- Automatic Mutation: When a property is registered, the system auto-generates or updates the Vacant Land Tax Identification Number (VLTIN) and sends assessment details via SMS, including payment links.

- No Manual Delay: All new and existing properties are assessed instantly, eliminating pendency and manual discretion.

- VLTIN Usage:

GHMC Vacant Land Tax Calculation & Payment Process

Gather Required Documents

- Registered Sale Deed (proof of ownership)

- Link documents attested by a Gazetted Officer (ownership history)

- Latest Encumbrance Certificate (E.C.) and market value certificate

- LRS Regularization documents, if applicable.

Online Assessment & VLTIN Generation

- Register your property with the Registration Department.

- If not previously assessed, a new VLTIN generated and sent to GHMC online

- Receive SMS with assessment and payment links.

GHMC Verification

- Tax Inspector/Bill Collector inspects the property to verify title and eligibility.

- Tax imposed as per Section 199 of the GHMC Act.

Tax Calculation

- Tax levied at 0.5% of the capital value.

- For land adjacent to buildings, only the area exceeding three times the plinth area or 1,000 sq.m (whichever is less) is taxed at 0.5%.

Make Payment

- Pay GHMC vacant land tax online through the GHMC portal using your VLTIN

- Download the receipt for records.

Penalties and One-Time Settlement (OTS) for 2025

- Penalty: 2% per month on overdue tax until payment is made..

- OTS Scheme 2025: GHMC offers a 90% waiver on interest/penalties for taxpayers who clear principal and 10% of penalty by March 31, 2025. Those already paid in full will have 90% of penalty adjusted against future dues (highlight this benefit for defaulters).

Legal Provisions: GHMC Act

- Section 199: VLT applies to non-agricultural, non-appurtenant lands at 0.5% of capital value.

- Section 212: For vacant land adjacent to buildings, only excess area over three times plinth area or 1,000 sq.m is taxed at 0.5%.

Frequently Asked Questions (FAQs)

How do I check my VLTIN and tax dues?

Visit the GHMC portal, enter your VLTIN or property details, and view assessments and dues instantly.

What if my property not assessed yet?

Register with the Registration Department; the system will generate a new VLTIN and assessment automatically.

How to avoid penalties?

Pay VLT before the due dates (typically July 31 and October 15 annually) to avoid the 2% monthly penalty.

The GHMC Vacant Land Tax Calculator empowers Hyderabad property owners to accurately assess and pay their vacant land tax by applying 0.5% of the land’s capital value, ensuring compliance and avoiding penalties under the streamlined 2025 GHMC system.