KSmart Property Tax New Assesment Process Online

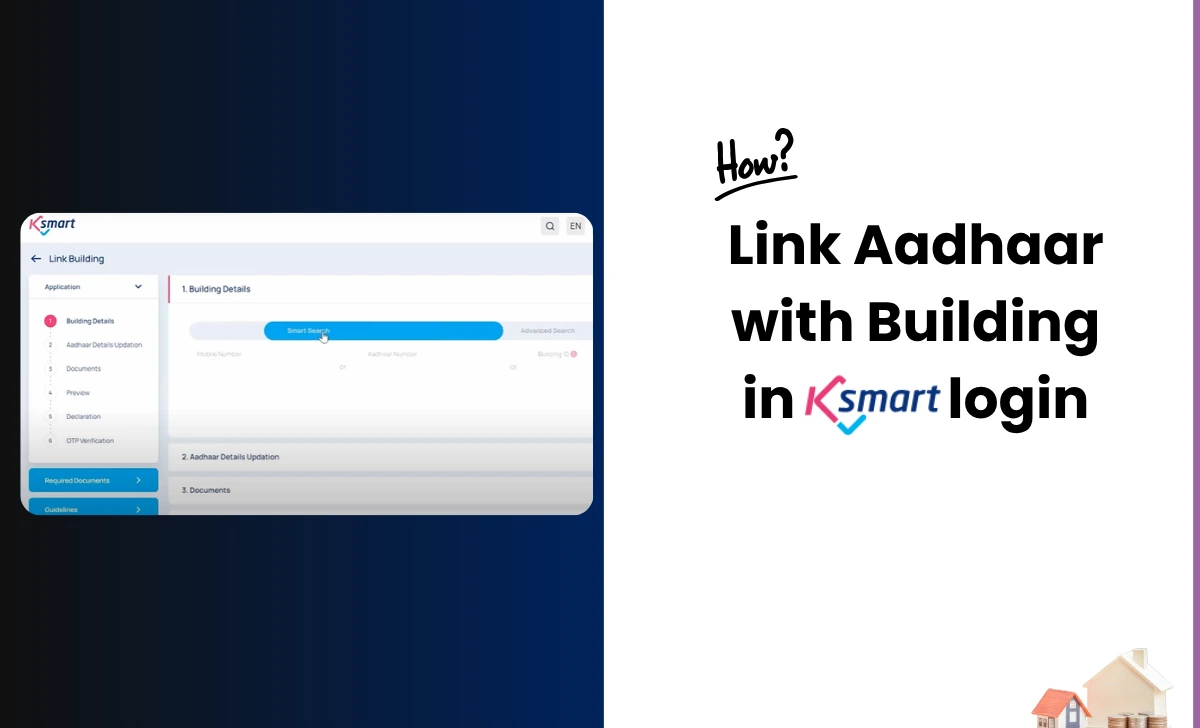

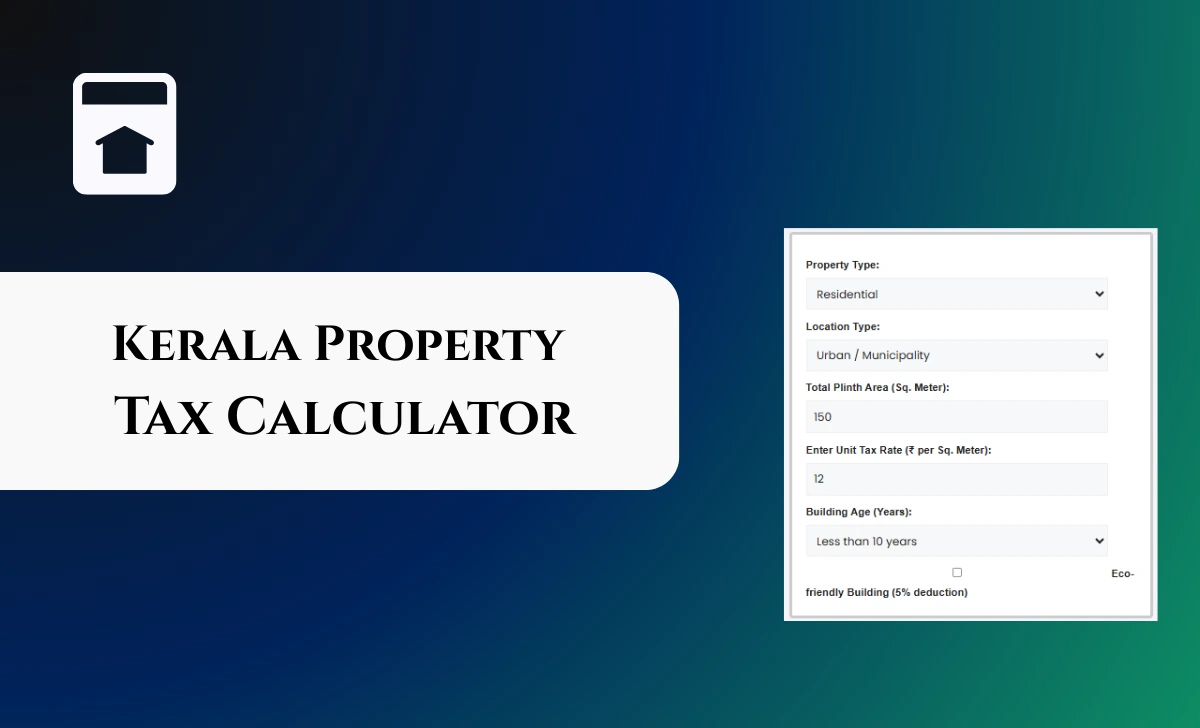

The Ksmart Property Tax Module streamlines the process of new tax assessment for buildings in Kerala’s local bodies. Here are the new instructions for completing a new tax assessment, based on the referenced videos and official documentation: How to Raise Kerala Property Tax Assessment at Ksmart Also Read: How to Report Missing Building in Ksmart Property Tax By following these steps, citizens can efficiently complete ...