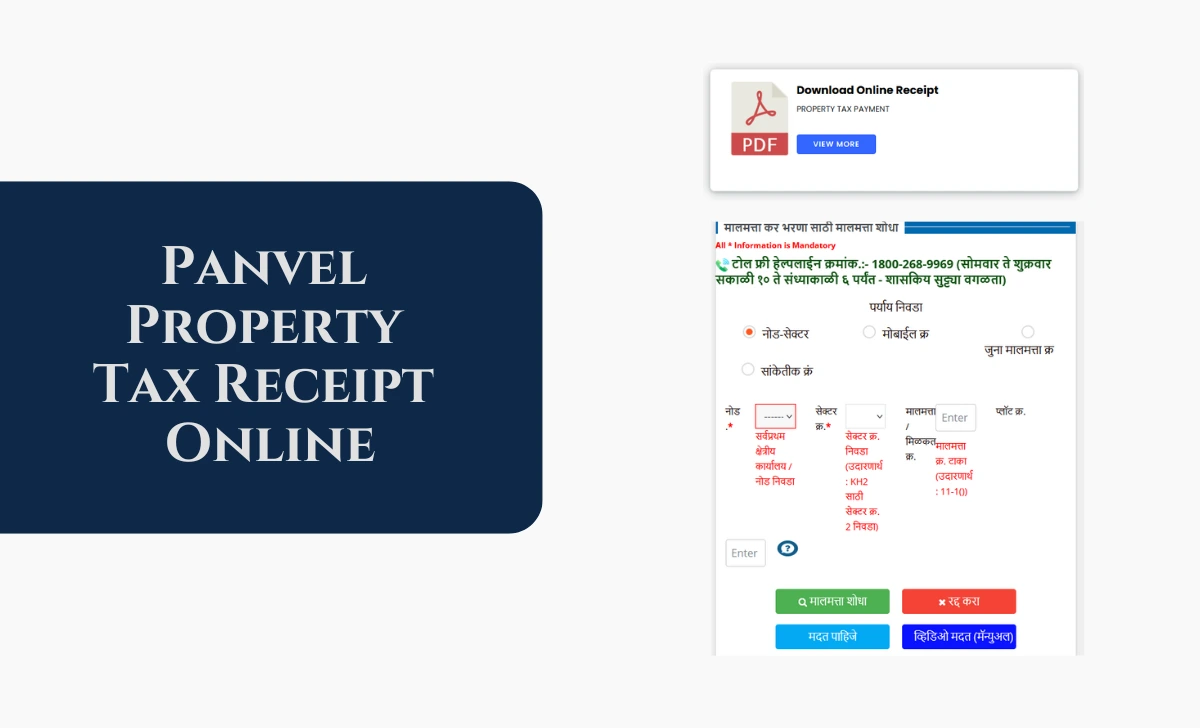

5 Steps to Download Panvel Property Tax Receipt Online

Panvel property tax receipt download is a crucial process for homeowners and property investors under the Panvel Municipal Corporation (PMC). It serves as proof of tax payment and aids in financial planning. This article outlines the simple process for downloading Panvel Property Tax payment receipt online, ensuring a hassle-free experience. How to Download Panvel Property Tax Receipt Follow these steps to download your Panvel tax ...