Paying your Panvel property tax payment in online is now easier than ever, thanks to the user friendly systems introduced by the Panvel Municipal Corporation property tax department.

Whether you choose online or offline methods, PMC ensures a seamless process for all taxpayers.

This taxlekka guide will help you navigate the payment process, understand available discounts, and avoid penalties.

Panvel Property Tax Online Payment

The online method is one of the most convenient ways to handle your Panvel property tax payment. Follow these steps:

- Visit the Official Portal: Go to the Panvel municipal corporation property tax portal page panvelmc.org/pages/onlinepayment.aspx.

- Select Your Property Identification Method: Choose one of the following options to retrieve your property details:

- Node-Sector: Select your node (e.g., New Panvel) and sector number from the dropdown menu.

- Mobile Number: Enter your registered mobile number.

- Unique Property Identification Code (UPIC): Input your UPIC to fetch details.

- Plot Number: Enter your plot number if applicable.

- Search for Property Details: Click on “माहिती शोधा” (Search Information) to view your tax details.

- Verify Tax Amount and Discounts: Review the total tax amount and check for any eligible discounts such as solar energy or rainwater harvesting rebates.

- Choose a Payment Method: Select from UPI, net banking, debit card, or credit card options.

- Complete Your Payment: Follow the instructions to complete the transaction securely and save your transaction ID for reference.

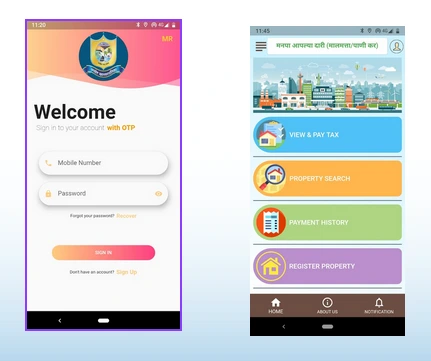

Pay Panvel Property Tax Online Using PMC Tax App

The PMC Tax App is another convenient option for managing your Panvel property tax payment:

- Download the app from Google Play Store or Apple App Store.

- Log in using your mobile number and authenticate with an OTP.

- Enter your Property ID or UPIC to fetch outstanding dues.

- Verify the amount and proceed with payment using UPI or other available methods.

Payment Gateway Charges

While paying online through the Panvel municipal corporation property tax portal, note these charges:

- Net Banking/Debit Card/UPI: No additional charges apply.

- Credit Card Payments: A transaction fee of 0.90% + 18% GST is applicable.

Troubleshooting Failed Transactions

If you encounter issues during online payments for Panvel mahanagar palika property tax, follow these steps:

- Check if your bank account has been debited.

- Wait up to three working days for reconciliation by PMC systems.

- If no update appears after three days, contact PMC customer care via email at [email protected] or call their helpline at 18002689969.

- Provide your transaction ID and payment details.

Offline Payment of Panvel Property Tax at Municipal Offices

For taxpayers who prefer traditional methods, offline payments can be made at municipal offices under the Panvel mahanagar palika property tax system:

- Visit the nearest PMC office during working hours.

- Provide your Property ID or UPIC at the counter.

- Pay via cash, cheque, or demand draft (DD). Ensure you collect a stamped acknowledgment as proof of payment.

Conclusion:

By following this guide, paying your Panvel property tax becomes easier with your multiple options available online through portals and apps or offline at municipal offices with applicable discounts under Panvel municipal corporation property tax to contribute to Panvel’s growth.