Need to track Telangana property tax payment status for property tax dues, this guide provides a step-by-step process to check Telangana payment status online along with various services.

Managing payments for taxes, utility bills, and municipal services in Telangana has become more streamlined with the availability of online portal, just have a look for better visibility.

Checking your Telangana property tax payment status online is now easier than ever with dedicated portals for various services like property taxes, vehicle taxes, commercial taxes, and utility bills.

How to Check Telangana Property Tax Payment Status Online

Based on eMunicipal Telangana portal, here is a step-by-step process to check the payment status online

- Visit the eMunicipal Telangana payment status page cdma.cgg.gov.in/CDMA_ARBS/General/

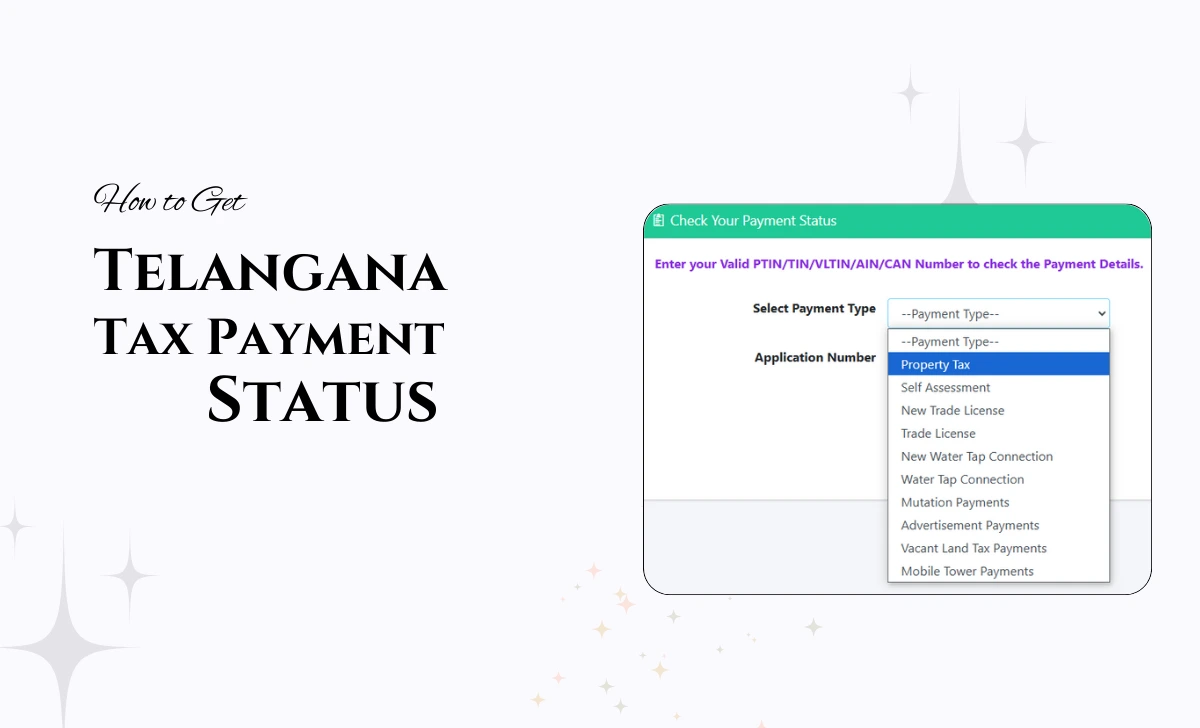

- Select Payment Type:

- Use the dropdown menu to choose the type of payment you wish to check for

- Property Tax

- Self Assessment

- Trade license

- New trade License

- Water Tap Connection

- New Water tap Connection

- Mutation Payments

- Advertisement Payments

- Vacant Land Tax payments

- Mobile Tower payments

- Use the dropdown menu to choose the type of payment you wish to check for

- Enter Application Number for your requirement:

- In the field labeled Application Number, enter your valid identifier, such as PTIN (Property Tax Identification Number), TIN (Trade Identification Number), VLTIN (Vehicle License Tax Identification Number), AIN (Assessment Identification Number), or CAN (Citizen Account Number).

- Press the yellow “Get Details” button to retrieve your payment status.

- View Payment Status:

- The system will display the payment details associated with the entered information.

Notes:

- Ensure that you have the correct identification number for accurate results.

- For technical support, you can contact the helpline at 040 2312 0410 or email cdmasupport @ cgg. gov.in during working hours (10:00 AM to 5:00 PM on working days).

- The portal indicates that online information is up-to-date, and physical visits to municipal offices may not be necessary unless required.

Tips for Accurate Payment Tracking in Telangana

- Always use the correct identifier (PTIN, TIN, CAN) as per your selected service.

- Ensure that your internet connection is stable during transactions to avoid errors.

- For technical issues, contact support via helpline numbers or email addresses provided on respective portals.

By following this guide and using identifiers such as PTIN or TIN, you can efficiently manage your payments without visiting government offices physically. Whether it’s tracking Telangana property tax payment status for pending dues or generating receipts, you may ensure transparency and convenience in handling financial obligations across Telangana.