The Telangana property tax reassessment process is essential for updating tax records due to changes like additional construction or usage modifications.

This guide outlines the Telangana property tax reassessment online application process, required documents, and penalties for incorrect declarations, ensuring you navigate the procedure seamlessly.

Telangana Property Tax Reassessment Process

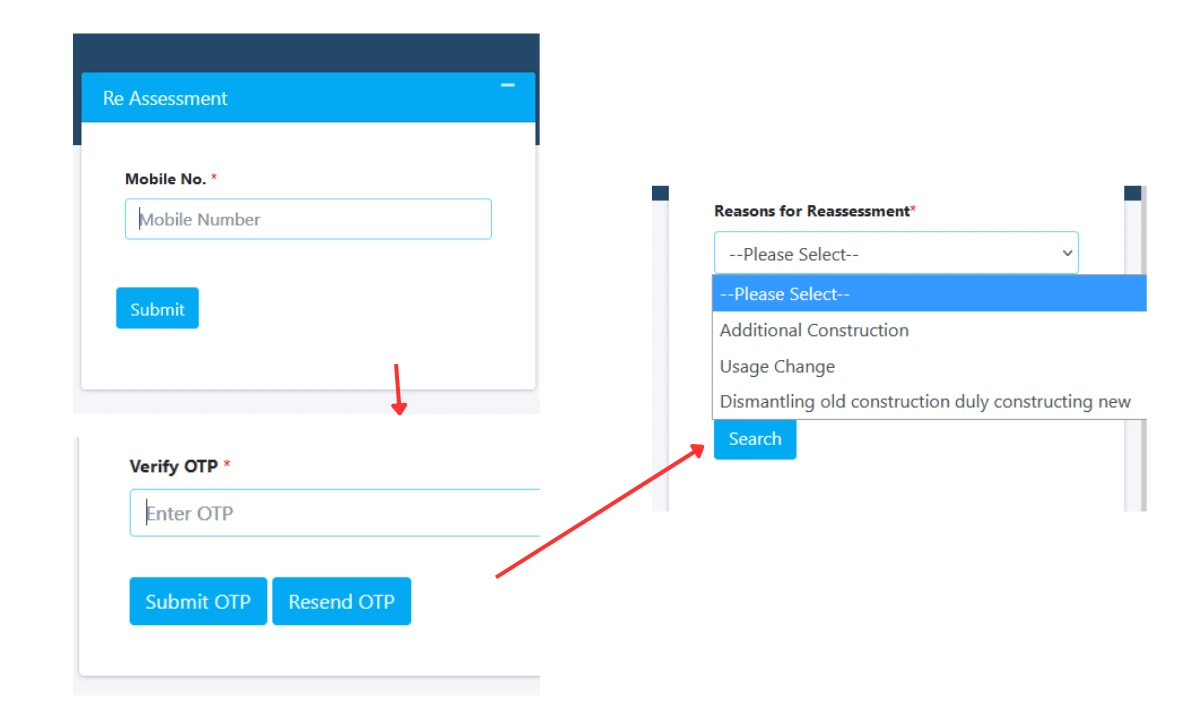

1. Initiate the Application Online

- Visit the official reassessment portal: emunicipal.telangana.gov.in

- Enter your mobile number and verify it using the OTP sent to your phone. This step is mandatory for accessing the reassessment form.

2. Select the Reason for Reassessment

Choose one of the following reasons based on your property changes:

- Additional construction

- Change in property usage (e.g., residential to commercial)

- Dismantling old structures and constructing new ones

3. Enter PTIN

- Fill Telangana PTIN and search to proceed further

4. Provide the New Property Details

Fill in all required fields, including:

- Property location and measurements

- Property location and measurements

- Building permissions and approvals

- Modifications made since the last assessment

4. Upload Supporting Documents

Attach the necessary documents to validate your application:

- Building permission certificates

- Ownership proof

- Photos of modifications or new structures

Ensure accuracy in your submissions, as false declarations could result in penalties under Section 94(3) of the Telangana Municipalities Act, 2019.

5. Tax Calculation and Payment

The system automatically calculates the half-yearly property tax based on your inputs and Payment can be made using:

- Internet banking

- Debit/Credit cards

- UPI or QR codes

Upon payment, an acknowledgment receipt will be generated along with an SMS notification.

6. Approval and Issuance of Reassessment Order

The Municipal Commissioner reviews your application within 15 days as per the Service Level Agreement (SLA). Once approved, you can download the reassessment order containing both old and updated tax details.

Key Features of Telangana Property Tax Reassessment

- Online Accessibility: Applications can be submitted entirely online, eliminating the need for physical visits.

- Transparency: Instant tax computation ensures clarity and accuracy.

- Timely Processing: The 15 day SLA ensures quick approval and order issuance.

- Multiple Payment Options: Payments can be made via various digital methods for convenience.

Documents Checklist for GHMC Property Tax Reassessment Application

To ensure a smooth process, gather these documents:

- Latest telangana property tax receipt

- Building permission approval

- Ownership proof (e.g., sale deed)

- Photos of new or modified structures

Penalties for False Property Declarations

Under Section 94(3) of the Telangana Municipalities Act, penalties include:

- Levying actual tax along with a one-time penalty of up to 25 times the corrected yearly tax.

- Cancellation of reassessment orders based on false or baseless information.

- Legal action against applicants providing incorrect self-declarations.

Benefits of Telangana Muncipality Self-Assessment vs Reassessment

While Telangana property tax self assessment allows property owners to declare their property details voluntarily, reassessment is mandatory when structural or usage changes occur.

Both processes ensure accurate property tax computation in Telangana state, but differ in scope and requirements.