Download BBMP Property Tax Receipt Online in 2025

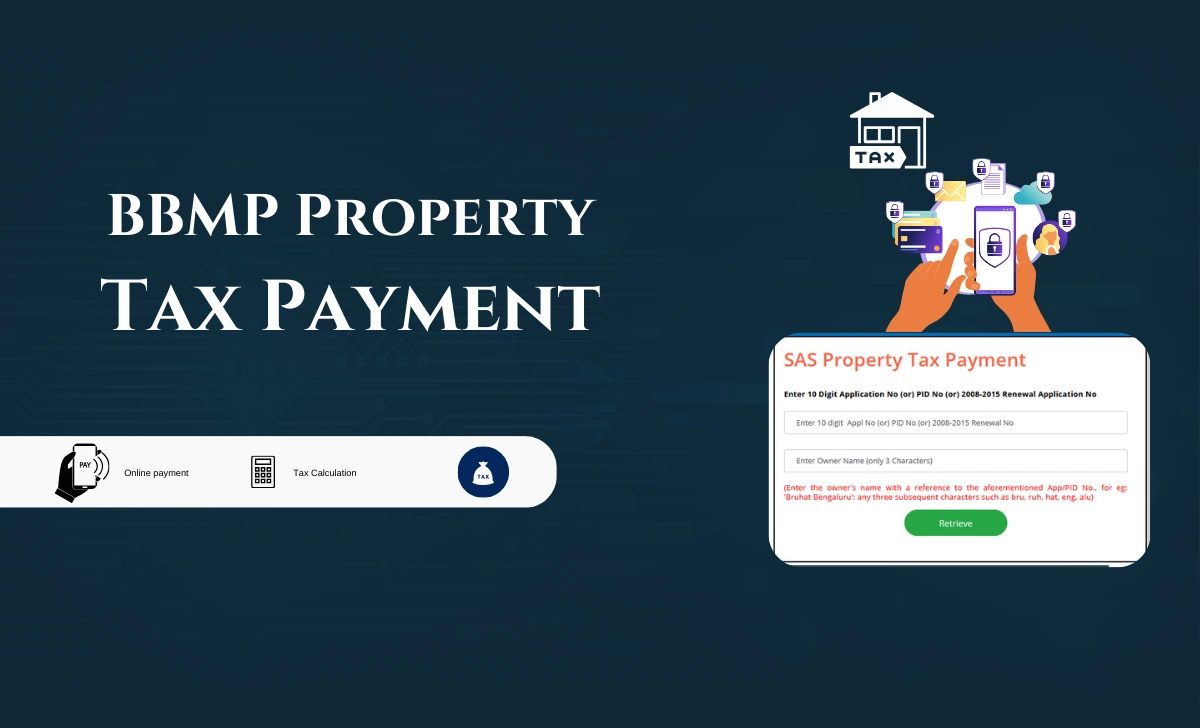

Managing property taxes in Bengaluru involves not only timely payments but also ensuring you have the BBMP property tax receipt as proof of compliance. This receipt is essential for legal, financial, and administrative purposes, such as property registration or securing loans. Here’s a comprehensive guide to help you download your BBMP property tax receipt seamlessly, including additional methods and clarifications. How to Download BBMP Property ...