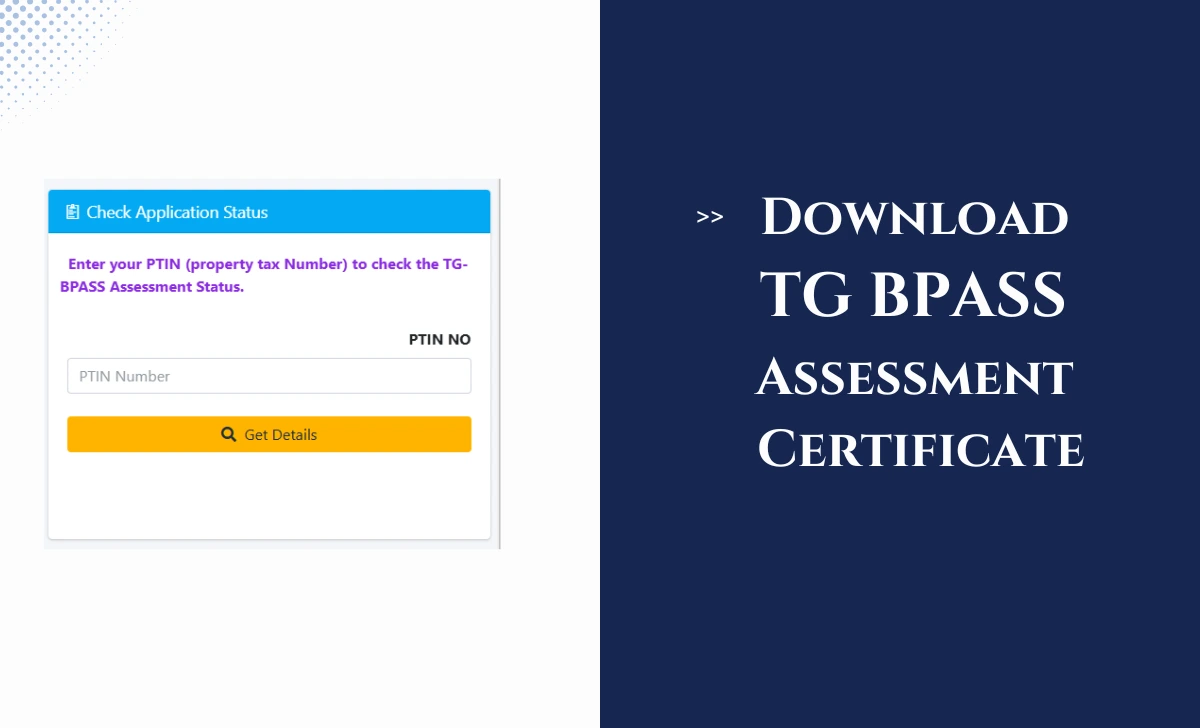

How to Download TG BPASS Assessment Certificate

The TG BPASS Assessment Certificate is an important document for property owners in Telangana. This certificate, issued by the Commissioner and Director of Municipal Administration (CDMA), Telangana, contains property tax assessment details and can be downloaded online through the official CDMA portal. Here’s a concise guide to help you download the TG BPASS Assessment Certificate without any hassle. Steps to Download TG BPASS Assessment Certificate ...