The latest Property tax calculator Telangana is an essential tool for homeowners and property investors seeking accurate tax estimates for properties within Telangana municipalities.

Whether you are a resident or a commercial property owner, understanding how to calculate house tax in Telangana is crucial for financial planning and legal compliance.

Telangana Municipality Property Tax Calculator

Enter values to calculate property tax

This guide explains the steps for using the calculator, payment methods, and special scenarios while ensuring compliance with local regulations.

How to Use Property Tax Calculator Telangana

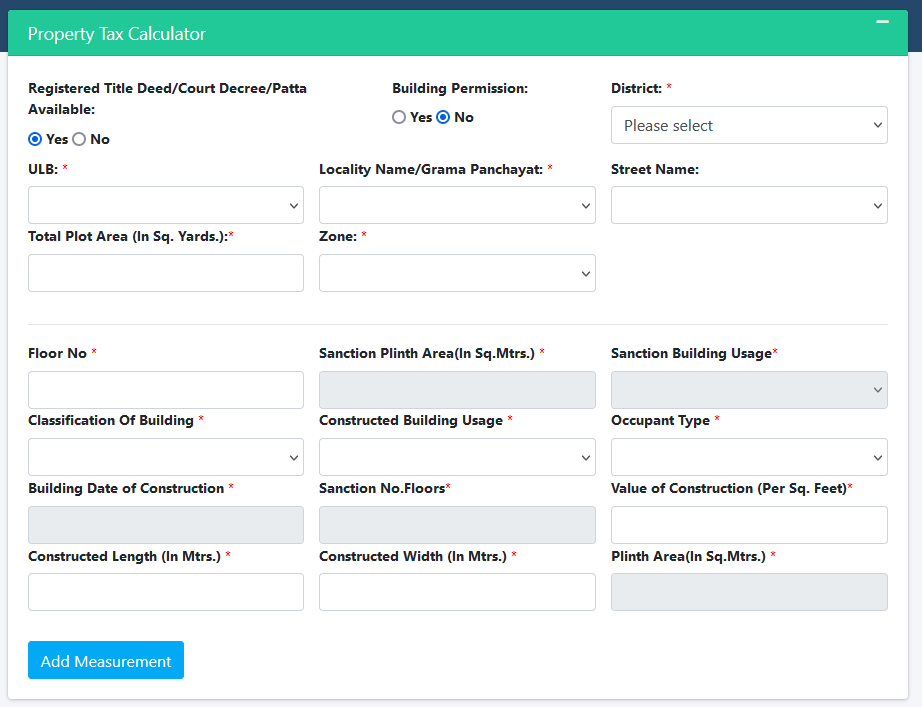

The Telangana Municipality Property Tax Calculator from official source allows property owners to estimate their tax liabilities accurately. Based on the image, here are the steps to use the calculator:

- Open the webpage: Click the page cdma.cgg.gov.in/PT_Tax_Calculator

- Registered Title Deed/Court Decree/Patta Availability: Select Yes or No, depending on whether you have the required document.

- Building Permission: Indicate if the building has permission by selecting Yes or No.

- District Selection: Choose your district from the dropdown menu.

- ULB (Urban Local Body): Select your municipality or urban local body from the dropdown list.

- Locality Name/Grama Panchayat: Enter the name of your locality or Grama Panchayat.

- Street Name: Fill in the street name where your property is located.

- Total Plot Area (in Sq. Yards): Enter the total area of your plot in square yards.

- Zone: Select your zone from the dropdown options.

- Floor Details: Specify the floor number for which you are calculating property tax.

- Sanction Plinth Area (in Sq. Mtrs): Provide the sanctioned plinth area in square meters.

- Sanction Building Usage: Enter how the building is sanctioned for use (e.g., residential, commercial).

- Classification of Building: Choose your building’s classification type (e.g., RCC, semi-permanent, hut).

- Constructed Building Usage: Specify how the building is currently being used (e.g., residential, commercial).

- Occupant Type: Select whether it is owner occupied or rented.

- Building Date of Construction: Enter the date when construction was completed.

- Sanction Number of Floors: Provide details about how many floors were sanctioned for construction.

- Constructed Length and Width (in Mtrs): Enter the constructed length and width of your property in meters.

- Value of Construction (Per Sq. Feet): Input the cost of construction per square foot.

- Plinth Area (in Sq. Mtrs): Specify the total plinth area in square meters for tax calculation.

- Click on Add Measurement to save these details for further calculations.

Understanding What is Property Tax in Telangana

Property tax is a mandatory charge imposed by local municipalities on all property owners. The property tax calculator Telangana uses the Annual Rental Value (ARV) or Gross Annual Rental Value (GARV) to estimate your liability.

Key factors influencing the calculation include plinth area, property location, usage type (residential or commercial), and construction classification.

Property Tax Calculator GHMC

For those in Hyderabad, the property tax calculator GHMC provides city-specific rates for commercial spaces. The municipality tax calculator covers all other urban local bodies across Telangana, ensuring every property owner can access tailored calculations.

How to Calculate House Tax in Telangana: Formula and Example

The process for how to calculate house tax in Telangana involves specific formulas based on property type:

Property tax in Telangana is calculated based on the Annual Rental Value (ARV) or Gross Annual Rental Value (GARV).

The ARV depends on property parameters such as plinth area, location, usage type (residential or commercial), and construction classification.

Residential properties are taxed at rates between 17% and 30%, while commercial properties are taxed at higher rates due to their revenue-generating potential.

Residential Property Tax Formula:

Annual Property Tax = Plinth Area *(MRV×12) * (17%−30%)- 10% + 8% Library Cess

Commercial Property Tax Formula:

Annual Property Tax = Plinth Area * (MRV×12) * 30% + 8% Library Cess

Downloadable Property Tax Calculator Telangana PDF

For those seeking offline reference, a property tax calculator Telangana PDF is often available on official portals, providing step-by-step guidance and formulas for manual calculations.

Steps for Online Property Tax Payment

TG state provide Telangana property tax online payment option for all muncipalities through CDMA portal, so after using the Telangana property tax calculator, you can pay your dues as below:

- Log in to your municipality’s official website.

- Navigate to “Property Tax” under “Online Payments.”

- Enter your Property Tax Identification Number (PTIN) or door number.

- Verify details such as arrears and interest on arrears.

- Choose a payment mode (credit card, debit card, net banking) to complete the transaction.

Offline payments can also be made at MeeSeva centers, Citizen Service Centers, or designated bank branches.

Using the property tax calculator Telangana ensures compliance and provides accurate tax estimates for all property owners. Whether you need the GHMC property tax calculator or a general Telangana property tax calculator, these tools simplify the process and help you understand how to calculate house tax in Telangana effectively.